South Africa’s higher education sector is in the midst of a digital revolution, and QR Code payment systems are leading the charge. Universities and colleges are shifting away from cash-based transactions in favour of digital solutions that are faster, safer, and more efficient.

The timing couldn’t be better. In 2024, Sub-Saharan Africa recorded over US$1.1 trillion in mobile money transactions, a 15% year-on-year increase that underscores the region’s accelerating shift towards digital adoption. QR payments are a natural extension of this growth, offering campuses a secure, mobile-first solution that aligns perfectly with the habits of today’s tech-savvy students.

For students, QR payments mean no more standing in long queues and the need to carry cash, while providing the convenience of paying directly from their smartphones. For administrators, these systems streamline operations, reduce fraud risks, and improve financial oversight.

In this article, we’ll explore how QR Code payments are reshaping higher education in South Africa, compare them with traditional payment methods, and explain why now is the perfect time for universities to make the switch.

Table of Contents

The Rise of QR Code Payments in Higher Education

QR (Quick Response) codes have been around since the mid-1990s, originally developed in Japan for tracking automotive parts. However, it’s only in the last decade—especially after the pandemic—that they have emerged as a mainstream payment method.

Robust Mobile Money Momentum

Sub‑Saharan Africa is leading this transformation. In 2024, mobile money services in the region processed over $1.1 trillion, marking a 15% year-over-year increase and demonstrating strong adoption of digital transactions across the continent. According to McKinsey, Africa’s e-payments market overall is projected to grow by around 150% between 2020 and 2025, with QR technology playing a critical role in this expansion.

Meanwhile, universities in South Africa are in an environment ripe for QR adoption. As of early 2025:

- There were 124 million active cellular mobile connections, equating to 193% of the population.

- Internet penetration stood at 78.9%, with over 50.8 million internet users in the country.

These numbers highlight how conducive the South African higher education landscape is to mobile-first payment methods like QR codes.

Early University Adoption

Some universities are already taking the lead. For example, Stellenbosch University was the first in South Africa to roll out SnapScan as part of its cashless initiative, allowing students to pay for fees, printing, and internet balances without handling cash. This real-world example illustrates how QR systems streamline operations and enhance convenience on campus.

Some of the measurable benefits include:

- Reduced cash handling: minimising theft risks and human error.

- Faster transactions: eliminating bottlenecks during registration, fee payment, and meal purchases.

- Improved record-keeping: real-time reconciliation and automated reporting for accurate financial tracking.

Globally, universities such as the University of California, Davis (UC Davis), Rutgers University, and Babson College have partnered with platforms like Flywire to streamline tuition payments. Students can scan QR codes to initiate secure cross-border transactions, eliminating banking delays and reducing admin workloads for international student offices.

QR Code Payments vs. Traditional Payment Methods: A Comparative Analysis

To understand why QR Code Payment systems are gaining dominance, let’s compare them to conventional payment methods still used in many South African universities:

| Payment Method | Pros | Cons |

|---|---|---|

| Cash | Universally accepted; no tech required | High theft risk; slow processing; manual reconciliation |

| Debit/Credit Cards | Fast; widely trusted | Requires POS devices; high transaction fees |

| Bank EFTs | Suitable for large sums; no physical handling | Delays of 1–3 days; manual tracking needed |

| Mobile Wallets | Convenient; mobile-friendly | Limited interoperability between platforms |

| QR Code Payments | Instant, secure, low cost, compatible with any mobile wallets | Requires smartphone & internet connectivity |

Verdict: QR code payments combine the speed and affordability students want with the security and oversight universities need, making them the most versatile option for modern campuses

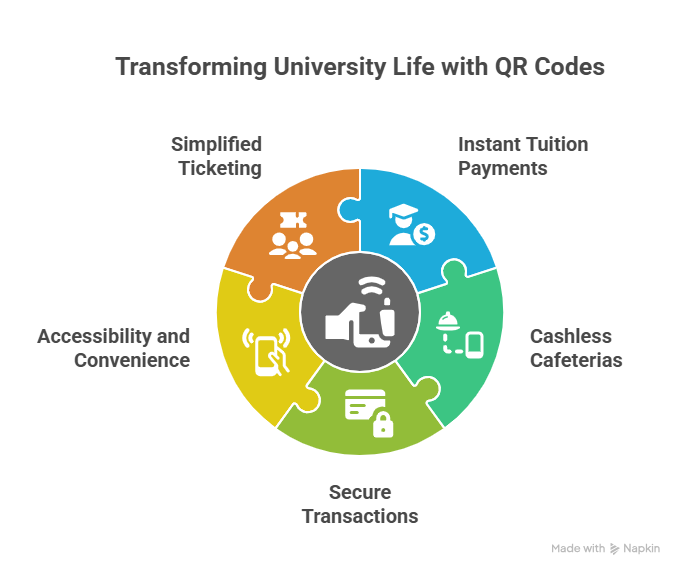

5 Ways QR Code Payments Are Transforming University Life

1. Instant Tuition & Fee Payments

Traditional EFTs can take several days to reflect, causing uncertainty during critical academic periods. With QR payments, students can scan, confirm, and receive immediate proof of payment, allowing them to register for classes or sit for exams without delay, ensuring timely fee settlements.In South Africa, adoption is already visible. STADIO, for instance, explicitly promotes QR code payments for tuition and other fees, allowing students to make convenient online transactions by simply scanning.

2. Cashless Cafeterias & Retail Outlets

On-campus dining is one of the busiest operations on university campuses, often resulting in long queues during meal times. Platforms like Pay & Connect enable students to redeem food vouchers or pay for meals instantly via QR codes, thereby reducing wait times and increasing turnover for vendors. Not only does this reduce wait times, but it also boosts turnover for campus vendors by enabling them to serve more students in less time.

3. Secure, Fraud-Resistant Transactions

Cash transactions are vulnerable to theft, while card skimming remains a risk. QR code payment systems use encrypted, one-time codes that expire after each transaction, making fraud nearly impossible.

Banks like FNB and Standard Bank integrate QR payment platforms such as SnapScan and Masterpass into their apps, offering students and administrators trusted, widely accepted payment options.

4. Accessibility and Convenience for Students

Not all students carry bank cards, and cash poses obvious risks such as loss or theft. Smartphones, however, are nearly universal among university students, making them a powerful tool for payments. With QR codes, learners can instantly pay using the banking or wallet apps on their devices. This ensures broad accessibility, faster adoption, and seamless integration into students’ daily digital habits.

5. Simplified Event Ticketing & Residence Payments

Managing payments for events and residence fees can be complex. QR codes simplify this process by allowing administrators to generate unique codes for different purposes. This streamlines reconciliation, reduces manual work, and enhances the overall efficiency of campus operations.

It also supports paperless ticketing, reducing waste and supporting campus sustainability goals.

The Broader Implications for South African Universities

Adopting QR code payment systems isn’t just about convenience—it’s a strategic move with long-term benefits:

- Cost Savings: Managing payments for events and residence fees can be a complex process. QR codes simplify this process by allowing administrators to generate unique codes for different purposes. This streamlines reconciliation, reduces manual work, and enhances the overall efficiency of campus operations.

- Improved Student Experience: Faster, hassle-free payments enhance student satisfaction. The convenience of not carrying cash aligns with the safety-conscious nature of modern campuses, contributing to a more secure environment.

- Data-Driven Decision Making: Real-time transaction tracking enables universities to monitor revenue streams effectively. Automated reporting reduces accounting errors and provides valuable insights for strategic planning.

- Environmental Impact: Reducing cash usage and paper receipts contributes to environmental sustainability. By adopting QR code payments, universities can minimise their ecological footprint and promote green initiatives.

This shift isn’t just about payment convenience—it’s part of a larger digital transformation strategy for higher education.

How Eezipay Can Help Your University Go Cashless

If your institution is still reliant on cash or outdated payment methods, now is the time to upgrade. Eezipay offers custom QR Code Payment solutions designed for South African universities, enabling you to go fully cashless in weeks, not months.

Key Benefits of Partnering with Eezipay:

- Seamless integration with existing campus systems and banking partners.

- Custom solutions for tuition fees, cafeterias, events, and more

- Real-time tracking and reporting to improve financial management.

- Compliance with South African banking regulations.

Eezipay’s Cashless Campus initiative is designed to simplify every aspect of university operations. By automating payments, managing services, and streamlining processes, institutions can focus more on education and less on administration. The platform’s powerful analytics tools enable informed decision-making, driving efficiency and growth.

For further insights, explore our related articles:

- QR vs Card vs App: What’s the Best School Payment Method in 2025?

- How QR Codes Make School Payments Effortless [2025 Guide]

Conclusion: The Future Is QR

The shift to QR code payments is more than a tech upgrade. It’s a leap toward a smarter, more efficient, and inclusive higher education system. For South African universities, adopting QR solutions is becoming essential for staying competitive, future-ready, and student-focused.

By embracing this shift, universities can:

- Reduce administrative burdens through automated reconciliation.

- Enhance the student experience with faster, mobile-first payments.

- Boost financial transparency with real-time reporting and oversight.

- Support sustainability goals by reducing reliance on cash and paper receipts.

Now is the time to move beyond queues, manual reconciliations, and cash-handling risks and embrace a mobile-first, student-friendly payment ecosystem.

Ready to modernise your campus?

If your institution is considering the shift to a cashless environment, partnering with solutions like Eezipay can facilitate a seamless transition. With tailored services designed to meet the unique needs of educational institutions, Eezipay offers a pathway to a more efficient and inclusive future.

Contact Eezipay today and join the growing movement toward smarter, cashless universities.