Financial wellness is more than just having enough money in a student’s bank account – it is about equipping young people with the confidence and tools to manage their resources effectively, reduce stress, and make informed financial decisions. For students living in residences, financial wellness is crucial, as it directly impacts their ability to pay rent on time, budget for meals, and fully engage in campus life.

In South Africa, the conversation around student financial wellness has gained urgency. Rising accommodation fees, mounting debt levels, and inconsistent bursary disbursements are leaving many students financially vulnerable. For residence operators, these challenges extend beyond students’ personal struggles; they affect occupancy rates, arrears management, and ultimately the sustainability of student housing operations.

Supporting financial wellness is both a moral imperative and a strategic necessity. When students can manage their money effectively, they are more likely to succeed academically, remain enrolled, and fulfil their financial obligations. By incorporating affordability measures, digital payment systems, and financial education into student housing, universities and operators can create an environment that fosters student success both personally and academically.

This blog discusses the significance of financial wellness for student residences, focusing on challenges such as affordability, bursary pressures, and debt issues. It also examines how digital payment solutions can foster healthier financial ecosystems for both students and institutions.

Table of Contents

1. Understanding Student Financial Wellness

“Financial wellness” refers to a state in which an individual is not just meeting their basic financial commitments (rent, tuition, food, transport), but also can absorb unexpected costs, plan for the future, and make choices that support well-being rather than just survival. For students, that means balancing academic demands with financial pressures, including finding ways to budget, manage debt, access funding, and avoid the stress of falling behind.

In South Africa, student financial wellness is increasingly recognised as essential to retention, mental health, and equitable access to higher education. A student who struggles financially is more likely to drop out, perform poorly, or avoid participating fully in residence life or campus activities. From the side of residence operators, financial wellness has direct implications for operations, budgeting, arrears, and overall reputation.

2. Affordability Challenges in Student Residences

Students today face a confluence of affordability challenges:

- Rising accommodation costs: Private and university-managed residences are under pressure to upgrade infrastructure, provide better amenities, and comply with safety / regulatory standards, all of which increase overheads. These get passed on to students through higher residence fees.

- Inflation and cost-of-living increases: Food, transport, utilities, and study materials are all increasingly expensive. Students often underestimate these “hidden” costs when budgeting.

- Transparent pricing and up-front communication: Sometimes fees for meals, laundry, utilities, internet, etc., are not clearly communicated or packaged, which complicates budgeting for students.

Here is a typical breakdown of monthly expenses for a university student living in residence in South Africa (figures illustrative, approximate, to demonstrate scale):

| Budget Item | Approx Cost (ZAR) | Notes |

|---|---|---|

| Accommodation rent | 3,500 – 6,000 | Depending on location, quality, private vs public |

| Meals/food | 2,000 – 3,500 | If using residence catering vs self-catering |

| Utilities & internet | 500 – 1,200 | Electricity, wifi, data, etc. |

| Transport (local) | 500 – 1,000 | Commuting or public transport |

| Study materials/books | 300 – 800 | Depending on the programme |

| Miscellaneous (social, clothes, personal care) | 800 – 1,500 | Variable but essential for wellness |

These numbers can add up quickly. Students are not just paying rent and tuition—they also have daily living costs which, if not planned for, lead to unanticipated pressure.

3. Bursary Pressures and Funding Realities

Bursaries are a lifeline for many, but they come with their own complexities.

- NSFAS (National Student Financial Aid Scheme): NSFAS is the major vehicle for financial aid for disadvantaged students. However, in many cases, delays in the disbursement of allowance or payment for accommodation lead to students being unable to settle residence fees on time, even when funding has been approved.

- Funding shortfalls and eligibility issues: Not everyone qualifies; sometimes students fall into the “missing middle,” meaning too wealthy to qualify for government financial aid, but not enough to comfortably bear full tuition fees and residence costs.

- Operational impact on residences: Delayed payments from bursaries cause cash-flow challenges for residence operators, who may be waiting on NSFAS or internal funds. This situation can adversely affect maintenance, service delivery, and staff payments.

- Student stress and uncertainty: When students are uncertain about when they will receive funding, or whether it will cover their full costs, it becomes difficult to plan. This uncertainty can lead to missed deadlines, financial arrears, and, sometimes, students may need to live elsewhere temporarily.

Ultimately, delays and shortfalls in bursary funding undermine financial wellness, leaving students unable to plan or budget reliably.

4. The Growing Issue of Student Debt

Student debt remains a significant concern in South Africa.

- “Historic student debt” is a recurring theme—debt carried over from earlier years that is unresolved, often via NSFAS or university debt forgiveness policies. It continues to impact students’ ability to re-register or take exams.

- According to Research Professional News, citing Universities South Africa, outstanding student debt had ballooned to around R16.5 billion by 2022. Rising fees, inflation, and limited state funding are the primary drivers of this “debt mountain.

- Unpaid accommodation fees contribute to the broader challenge of debt. When students fall behind on their residence payments, it causes financial and administrative difficulties for both them and the residence operator.

- Debt impacts more than just financial statements; it also has significant effects on mental health, student engagement, and retention rates. The stress associated with owing money, such as the risk of exclusion, loss of access to facilities, or being forced to leave on-campus housing, can harm students’ well-being and academic performance.

5. How Digital Payments Enhance Financial Wellness

Technological advances around digital payments offer powerful tools to improve financial wellness for students in residences and for the institutions that support them.

- Transparency and immediacy: Digital payment systems (e.g. QR payments, mobile wallets, direct transfers) provide students with immediate visibility of their transactions. They can see when payments have been posted and what their outstanding balances are, reducing any confusion about whether a payment has been received. This level of transparency fosters trust and aids in budgeting.

- For example, QR Code payments are already being embraced by some South African universities, helping students make fee or accommodation payments quickly and get confirmation of payment.

- For example, QR Code payments are already being embraced by some South African universities, helping students make fee or accommodation payments quickly and get confirmation of payment.

- Reduced administrative burden: Residence operators and university finance teams spend less time chasing paper, reconciling payments, handling cash (which is prone to errors, delays, and loss), or dealing with manual receipts.

- Better alignment with bursary systems: If digital payments are integrated with bursary and financial aid disbursement systems (such as NSFAS), funds could be channelled more directly into residence accounts or via mechanisms that automatically settle residence fees. This reduces lag and uncertainty.

- Enabling flexible payment options: Digital platforms often allow splitting payments, setting instalments, automated reminders, and micro-payments. These help students manage their cash flow, particularly those with irregular income or who receive funds at different times.

- Financial inclusion, security, and record-keeping: Digital systems create records, reduce the risk of loss or theft of cash, and permit students to build a financial “behaviour portfolio” that could help with credit, trust, or accessing other financial services in future.

In this way, digital systems are not just about convenience — they are a foundation for student financial wellness.

6. Building a Culture of Financial Literacy and Wellness

Digital tools are vital, but they must be accompanied by education, culture, and support.

- Budgeting education and workshops: Residence operators, student support services, and university finance offices should collaborate to offer sessions on budgeting, debt avoidance, understanding interest and fees. Incorporating these sessions into orientation or the early part of the academic year is beneficial.

- Peer support systems: Student mentors or peer advisors who have faced financial challenges can offer practical tips, such as how to budget for groceries, save on utility costs, or prepare for unexpected expenses.

- Clear, transparent communication: Regular statements of account, reminder notices, breakdowns of what is owed and why. This builds trust and prevents small debts from ballooning.

- Mental health support: Financial stress can contribute to mental health issues. Student support services need to recognise when students are experiencing financial difficulties and refer them to appropriate resources.

- Partnering with fintech / financial institutions: For example, platforms that offer “smart wallets”, budgeting tools, micropayment splitting, or cashless services in laundry or meals. These partners can help provide services that residents may not have.

7. Practical Steps for Residents to Support Financial Wellness

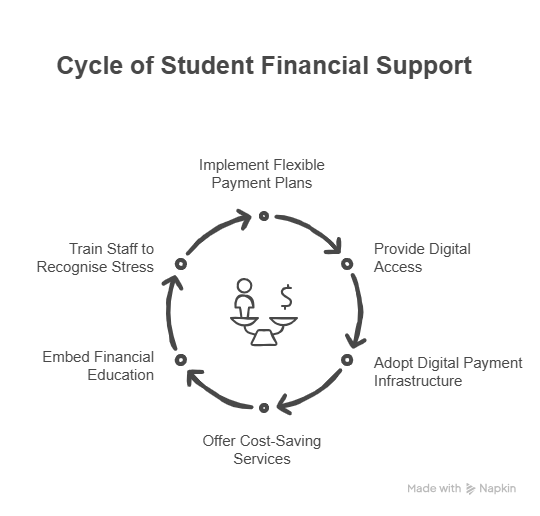

To translate these insights into action, here are practical steps residence managers and support teams can adopt to strengthen student financial wellness.

- Flexible, transparent payment plans: Allow instalment options for residence fees; clearly indicate when fees are due, what penalties (if any) apply, and when bursary funds are expected.

- Use of digital receipts, statements, and dashboards: Give students access to online portals where they can check balances, past payments, upcoming due dates, and download statements.

- Adopt cashless & digital payment infrastructure: Utilise QR payments, integrate with mobile and bank apps, and wallets, while connecting with bursary or student loan systems.

- Offer optional cost-saving residence services: Self-catered meals versus those with catering, communal laundry versus personal washers, and energy-efficient lighting can help reduce utility expenses.

- Embed budgeting tools and education into residence life: Workshops, financial “tip sheets”, peer mentoring, and even competitions or incentives for good budgeting.

- Train residence staff to recognise and address financial stress: Staff who interact with students (supervisors, finance office, support services) should be able to spot early warning signs (missed payments, requests for deferments, late/bounced payments) and refer students to appropriate support.

- Better coordination with bursary and financial aid providers: Ensure that residence fee schedules, deadlines, and payment plans are aligned with bursary disbursement schedules (especially NSFAS) to prevent misalignment that causes students to slip into arrears simply because funding arrived late.

Building a Culture of Student Financial Wellness

Financial wellness is not optional—it’s central to student success, residence sustainability, and institutional reputation. For residence operators, university finance teams, and student support services, fostering financial wellness among residents means confronting affordability challenges, managing debt pressures, and harnessing digital innovations to make payments clear, fair, and manageable.

By combining affordability measures, digital payment tools, and financial education, student residences can create an environment where students are able to focus on learning, develop into responsible financial actors, and contribute positively to campus life. The long-term payoff is lower arrears, increased occupancy, enhanced student satisfaction, and healthier institutional budgets.

The opportunity is clear: residences that commit to building a culture of student financial wellness will not only ease the immediate pressures of affordability and debt but also position themselves as leaders in shaping a more resilient and equitable higher education system.

Towards Smarter, More Affordable Residences

If you oversee student residences or support services, now is the time to act:

- Discover how digital payments simplify student life in our blog: University Laundry Payments Made Easy

- See where the sector is heading with Student Housing Payments: Smart Future Guide for Operators

- Partner with Eezipay to empower financial wellness in your residence with cashless, transparent solutions tailored for South Africa.