Managing employee meals, subsidies, and workplace spending has become increasingly complex for large organisations. Finance, HR, and Payroll teams are under pressure to control costs, ensure SARS compliance, reduce manual reconciliation, and still deliver a seamless experience for staff.

If your organisation is still juggling meal vouchers, petty cash, paper slips, and disparate systems across sites or departments, these processes can quickly become inefficient and difficult to control. They create unnecessary administrative burden, introduce compliance risks, and make accurate reconciliation nearly impossible.

A closed-loop wallet system solves these challenges by creating a secure, ring-fenced digital payment environment inside your organisation. This system ensures that staff benefits are used as intended, transactions are fully auditable, and compliance is built in from day one.

This article explores how a closed-loop digital wallet operates, the benefits it delivers in terms of unmatched control and compliance, and how South African organisations are leveraging it to streamline operations.

Table of Contents

What is a Closed-Loop Wallet System?

In simple terms, a closed-loop wallet is a payment system in which funds are loaded into a dedicated digital wallet and can only be spent at approved merchants or a set of locations within the organisation.

Think of it like a gift card for a single store — but expanded into a comprehensive workplace ecosystem. The “loop” is closed because the money stays within your approved network.

Employees typically access the wallet using:

- A staff card (NFC-enabled)

- A mobile app

- A QR code or digital identifier

In this model, money circulates within a controlled ecosystem, rather than flowing into open consumer markets. This creates a secure, compliant environment for staff spending.

To learn more about workplace wallet systems in general, see The Ultimate Guide to Staff Wallet Systems: Definition, Benefits, and ROI

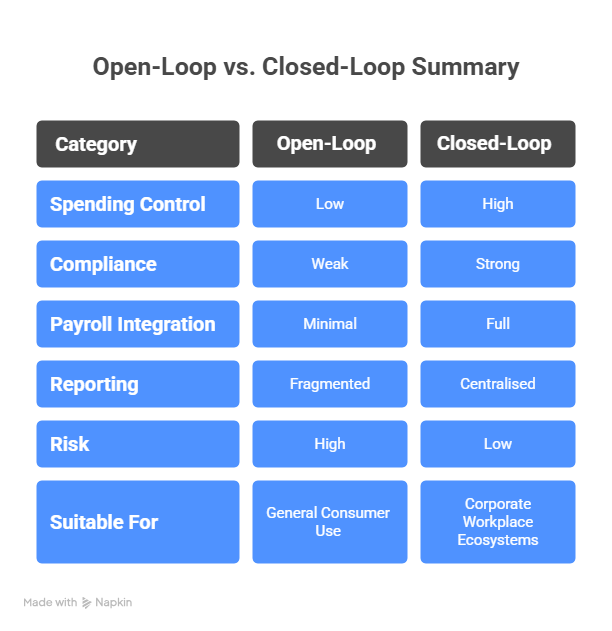

Open-Loop vs. Closed-Loop Payments: A Quick Comparison

For an Operations or HR Manager, understanding the difference is key to seeing the value.

| Feature | Open-Loop Wallet (e.g., Visa/Mastercard prepaid card) | Closed-Loop Wallet (e.g., Eezipay Staff Wallet) |

|---|---|---|

| Where it can be used | Anywhere the card network is accepted | Only at approved merchants or facilities |

| Control over spending | Low | High: funds are ring-fenced |

| Compliance | Difficult to prove correct usage | Built-in audit trail |

| Transaction fees | Standard bank/merchant fees | Lower or none within the internal network |

| Reconciliation | Complex, mixed spending types | Unified reporting platform |

| Risk exposure | High (fraud, cash-outs, misuse) | Low (no cash-out, merchant whitelisting) |

Open-loop systems are designed for consumer use, whereas closed-loop systems are built for organisational control.

The Three Types of Wallets

Understanding the various types of wallet systems is essential when evaluating a workplace solution. Each model offers a different level of control, compliance, and flexibility.

- Open-Loop Wallet

- Broad acceptance

- High risk, low organisational control

- Broad acceptance

- Semi-Closed Wallet

- Used at multiple partner merchants

- Examples: retail chains, fast-food groups

- Moderate control

- Used at multiple partner merchants

- Closed-Loop Wallet

- Used only at approved internal locations

- Ideal for HR, Finance, and Payroll compliance

- Examples include staff canteen wallets, workplace meal benefits, and internal staff stores

- Used only at approved internal locations

In corporate environments, the closed-loop model is the only system that ensures funds are spent exactly as intended.

What Is an Example of a Closed-Loop Payment?

A perfect real-world example is an employee meal wallet used at a staff canteen.

Funds are allocated monthly — for example, R1,000 for meals — and employees can only spend it at your approved canteen or workplace restaurant.

Other examples include:

- Factory or farm staff stores, where employees purchase discounted internal goods

- On-site vending machines linked to a staff wallet

- Workplace cafés or coffee shops

- Hotel campus staff meal benefits run as SARS-compliant fringe-benefit vouchers

- Payroll-integrated spending systems, where monthly usage is deducted from salaries

Organisations such as hotels, food producers, corporate campuses, and hospitality groups already utilise these systems to securely and efficiently manage staff benefits.

The ‘Control’ Factor: A Strategic Win for Operations

For Operations Managers, the primary benefits of a closed-loop wallet are security, efficiency, and financial oversight.

1. Ring-Fence Funds for Their Intended Purpose

With a closed-loop wallet, you can create multiple spending “pockets” such as:

- Meal subsidies

- Transport allowances

- Uniform or equipment allocations

- On-site retail purchases

Each pocket can only be spent at the correct merchant, ensuring budgets are followed exactly as intended.

2. Enforce Daily, Weekly, or Monthly Spending Rules

Closed-loop systems allow you to set:

- Daily limits

- Monthly caps

- Time-of-day rules

- Item/category-level restrictions

- Employee or department-level policies

These granular controls dramatically reduce the risk of overspending or fraud.

3. Eliminate Cash-Handling Risks

Cash introduces:

- Theft risk

- Discrepancies

- CIT costs

- Manual counting

A closed-loop wallet enables your canteen, stores, or vending machines to operate fully cashless, with secure digital transactions logged instantly.

4. Real-Time Visibility Across Every Department

Finance teams gain full visibility into workplace spending — all in real time:

- Transaction volumes

- Wallet balances

- Subsidy consumption

- VAT reporting

- Product-level sales data

This transforms your workplace financial data into a precise management tool.

To help you choose the right funding structure for your environment — whether prepaid, bulk-funded, or payroll-deducted — read our detailed comparison here: Prepaid vs Credit Wallet: Choosing the Right Staff Payment Model

The Compliance Advantage: Peace of Mind for HR

For HR and Finance teams, compliance is non-negotiable, especially regarding benefits, auditing and payroll.

1. Guaranteed SARS Compliance for Meal and Fringe Benefits

Many South African organisations offer meal subsidies or catered benefits. To remain compliant, you must prove that staff used the benefit only for approved items.

A closed-loop wallet:

- Prevents spending on non-qualifying items

- Ensures funds cannot be withdrawn

- Tracks every meal purchased

- Creates an audit-ready digital record

This aligns with SARS rules for fringe-benefit vouchers as outlined in the Seventh Schedule.

If your organisation offers meal subsidies or employee benefits, understanding SARS rules is essential. See our full breakdown on tax treatment and reporting in: Fringe Benefits and SARS Compliance

2. Full Audit Trail With Zero Grey Areas

Auditors can see:

- Which employee made a purchase

- What they bought

- When and where they spent

- Which subsidy bucket funded the transaction

This removes subjectivity and eliminates the risk of non-compliant or unexplained expenditures.

3. Payroll Integration and Automated Reporting

Closed-loop wallets can integrate directly with payroll systems, enabling:

- Automated monthly allowance loading

- Month-end deduction exports (for credit models)

- Bulk funding models for monthly floats

- Automated reconciliation

This dramatically reduces manual data entry and eliminates duplication between payroll, HR, and Finance systems.

Digital Wallet Convenience: A Better Experience for Employees

While the system is designed for Finance and HR teams, the user experience is built for staff.

Employees benefit from:

- Instant access to funds when payroll loads their benefits

- Tap-to-pay convenience using a card or app

- Real-time balance visibility

- Faster canteen and store queues

- No cash, no slips, no admin

Higher convenience leads to higher adoption — and a better return on your staff benefit investment.

Real-World Closed-Loop System Examples

Still wondering how this applies? Here are common closed-loop system examples in a modern workplace:

1. Smart Staff Canteens

Employees pay for meals from their meal subsidy wallet. Unused value doesn’t roll over, ensuring compliance.

2. Staff Stores in Agricultural or Manufacturing Environments

Employees access discounted internal goods through a payroll-integrated wallet, with month-end deductions.

3. Hotel & Hospitality Staff Meal Benefits

A fixed monthly meal value is allocated and taxed only on consumption — a fringe-benefit structure that’s fully SARS-compliant.

4. Vending, Parking, and Facilities Access

A single wallet is used for vending machines, hot-desking, parking, and locker bookings.

5. Visitor & Temporary Access Wallets

Short-term digital wallets for events, contractors, or interns enable controlled spending without creating new payroll accounts.

Take Control of Your Workplace Spending

A closed-loop wallet is more than a payment tool — it’s a strategic control system designed to simplify Finance workflows, eliminate compliance risk, and create a frictionless experience for staff.

Whether you’re managing a corporate campus, hotel group, factory, farm, or multi-site operation, a closed-loop wallet transforms your approach to staff benefits, workplace payments, and financial governance.

Ready to Streamline Staff Spending and Strengthen Compliance?

Book a demo to see how Eezipay’s closed-loop wallet system works in real-world environments, from meal benefits to payroll-linked spending and full compliance reporting.

→ Contact Eezipay today to get started.