A critical business decision lies at the heart of your payment processing: the choice of card terminal. Organizations must decide between a traditional, fixed point-of-sale (POS) terminal and a modern, portable card machine. While a fixed terminal is engineered for a static checkout environment, a mobile card machine can be a transformative solution, particularly for organizations operating in dynamic environments.

For delivery services, event-based vendors, or field service professionals, the capability to process payments from any location is not merely a convenience—it is essential for business expansion and operational efficiency. This guide outlines the key differentiators and demonstrates why a portable card machine is the optimal solution for a mobile enterprise.

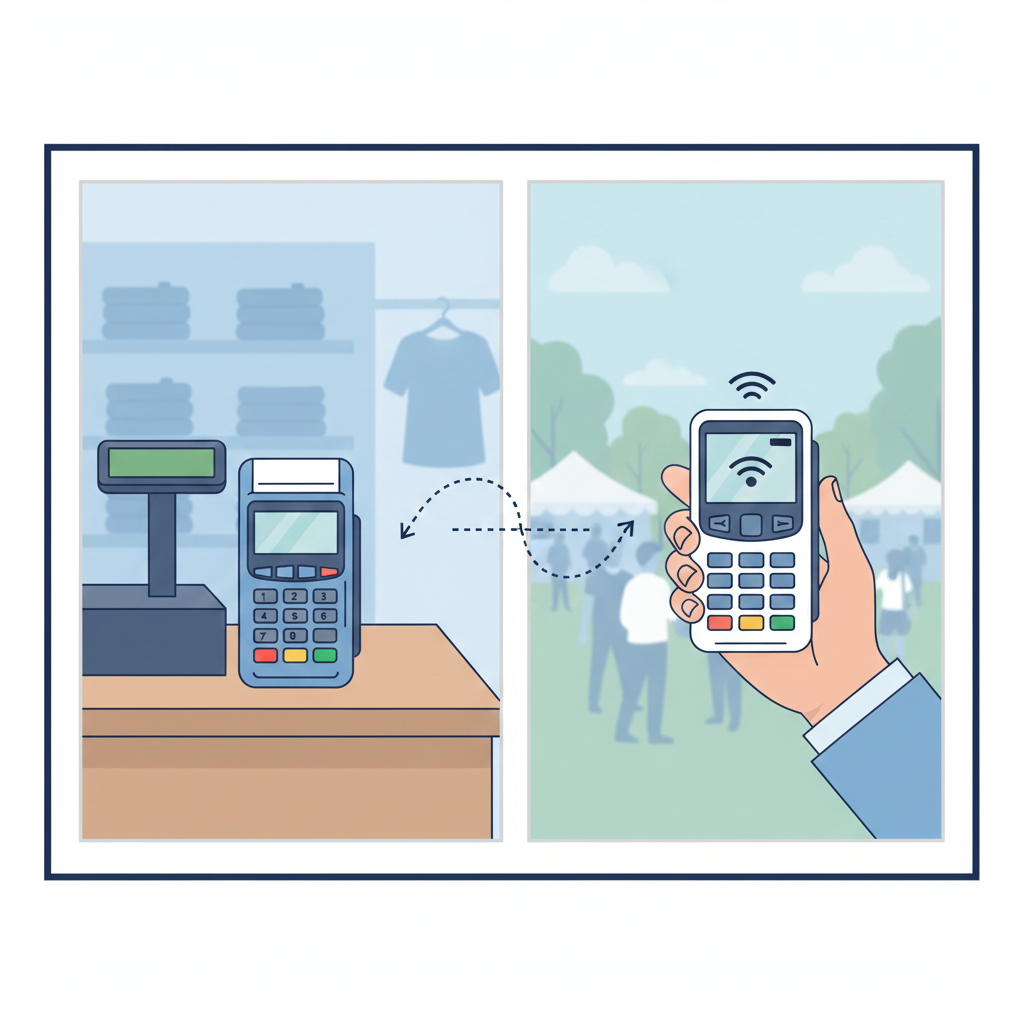

The Fundamental Distinction: Fixed vs. Portable Card Machine

The fundamental distinction between these two technologies is their operational location.

- Fixed Card Terminals: These are the conventional terminals integrated into checkout counters in large retail environments. They are robust, powered by a mains connection, and utilize a hardwired Ethernet connection for network connectivity. Their design is optimized for high-volume, single-location transaction processing and is limited to that single function.

- Portable Card Machines: These devices are compact, battery-powered, and portable. They establish network connectivity via Wi-Fi or by pairing with a smartphone’s 4G/5G mobile data connection through Bluetooth. This wireless capability empowers your organization to process payments from any location, from a client’s premises to a vendor booth at a high-traffic event.

4 Strategic Advantages of a Mobile Card Machine

For businesses that are not confined to a single, fixed storefront, the benefits of a portable card machine are significant. They directly address the fundamental challenges of processing payments in dynamic environments.

Benefit 1: Secure Immediate Payments in Any Location

The primary benefit is the ability to finalize a transaction at the exact moment your client or customer commits to the purchase.

Consider a logistics service delivering goods. A mobile card machine allows your driver to securely process a card payment directly at the point of delivery. This eliminates the need for delayed bank transfers, addresses issues arising from a lack of physical currency, and mitigates the risk of payment failure after goods have been exchanged. As noted by the U.S. Chamber of Commerce, the capacity to accept payments from virtually anywhere is a key advantage for business operations. Similarly, it allows an event vendor to process a payment from anywhere within their designated space, preventing revenue loss due to checkout friction.

Benefit 2: Enable Operational Flexibility Beyond a Fixed Location

A portable card machine empowers your organization with unprecedented operational flexibility. Your business is no longer tethered to a single physical location.

- Event-Based Retail & Hospitality: Manage sales at a weekend market and a large-scale festival using a single, integrated payment system.

- Mobile Service Professionals: Plumbers, electricians, and consultants operating on-site can secure payment immediately upon job completion, dramatically improving cash flow and reducing administrative overhead from invoicing.

- Restaurants & Cafes: Empower staff to accept payment at the table, creating a seamless and elevated customer experience while optimizing staff allocation away from a fixed till point.

Benefit 3: Accelerate Transactions and Enhance Customer Experience

In a high-volume environment, transaction speed is critical. Mobile card machines provide a distinct advantage by supporting contactless functionality, enabling rapid transactions that require only seconds to complete.

This capability is invaluable for optimising queue management at a popular market stall or food truck. A staff member can engage customers directly in the queue, processing orders and payments with a tablet and a mobile reader. This accelerates service and improves customer satisfaction. As a guide from Clover highlights, this enhances the customer experience and can significantly increase sales volume during peak operational hours.

Benefit 4: Optimised Cost Structure and Cash Flow

Traditional fixed terminals often require a substantial initial capital outlay, recurring monthly rental fees, and long-term contractual commitments. In contrast, a modern portable card machine is recognized for its cost-effective acquisition model.

Organizations typically acquire the device for a modest, one-time hardware cost and then operate on a simple, flat-rate transaction fee. There are no fixed monthly fees. This transaction-based pricing model is ideal for seasonal businesses or those with fluctuating sales volumes, as costs scale directly with revenue. You incur costs only when you generate sales.

Key Operational Considerations

While the benefits are substantial, two practical factors require consideration before fully transitioning to a mobile payment infrastructure.

Network Connectivity is Paramount

A mobile card machine’s performance is contingent upon its internet connection. When operating in remote areas with inconsistent mobile data coverage or at crowded events where networks are congested, you may experience reduced transaction speeds. It is crucial to assess network coverage in your operational areas and consider a device with the capability to switch between Wi-Fi and mobile data.

Power Management and Durability

Unlike a mains-powered fixed terminal, a portable card machine relies on an internal battery. While most are engineered to operate for a full business day on a single charge, diligent power management is required. Furthermore, their compact nature may render them more susceptible to damage from drops in demanding operational environments.

The Final Verdict: Making the Strategic Decision

For the majority of organizations that conduct business outside of a single, fixed storefront, a portable card machine is the superior solution. To determine the optimal choice for your enterprise, consider these three questions:

- Where are payments processed? If the answer includes “at the client’s location,” “in the field,” or “at temporary events,” a mobile card machine is required.

- What is our projected sales volume? If your sales are variable, seasonal, or in a growth phase, the low initial cost and transaction-based pricing model of a mobile card machine is more financially prudent.

- How critical is operational flexibility? If your strategy involves queue management, tableside payments, or pop-up sales initiatives, a portable card machine is indispensable.

Before you commit to a contract, ensure you have the full picture. There are nuances to POS technology that can make or break your daily operations. Ensure you are fully informed by consulting [Card Machine Explained: An Essential Guide for Your Business.

Empower Your Mobile Operations

Transitioning from a cash-only or invoice-based system to a mobile card payment solution is one of the most strategic upgrades a mobile enterprise can implement. A portable card machine streamlines the payment process, improves cash flow, and delivers the professional, secure experience that modern clients and customers demand. It is not simply a piece of hardware; it is a solution that empowers your organization to conduct business anywhere.