Defining POS Systems and Card Machines

While the terms are frequently conflated, a “POS system” and a “card machine” represent distinct technological solutions. Understanding this distinction is the first step toward strategically equipping your organization.

A Card Machine (Speed Point Machine)

A card machine—also referred to as a payment terminal, card reader, or the common local term “speed point machine”—is a portable device engineered for a single primary function: to securely accept and process debit and credit card payments.

Key Features of a Card Machine:

- Transaction-Centric: Its core function is to securely process payments via chip & PIN, tap-to-pay (NFC/contactless), or magnetic stripe.

- Form Factors: Available in multiple configurations, including standalone terminals with integrated printers and mobile card readers that interface with a smartphone or tablet via Bluetooth.

- High Mobility: Ideally suited for mobile operations, such as delivery services, event vendors, and field service professionals.

A card machine offers the most direct method for initiating card payment acceptance but lacks comprehensive business management functionalities.

Point of Sale (POS) Systems

A Point of Sale (POS) system is a more integrated and comprehensive solution. It combines hardware and software into a centralized platform designed to manage the entire sales process and additional operational functions. The payment terminal is merely one component of an integrated POS system.

Key Features of a POS System:

- Integrated Business Platform: It not only processes sales transactions but also provides real-time inventory tracking, manages user-level permissions, generates detailed sales analytics, and supports customer relationship management.

- Hardware Components: A typical configuration includes a primary display (often a tablet), a barcode scanner, a cash drawer, and an integrated payment terminal.

- Software-Driven Intelligence: The core software provides actionable business intelligence, enabling data-driven decisions by identifying top-performing products and analyzing peak operational periods.

A card machine facilitates a payment transaction, whereas a POS system empowers you to manage your business operations more effectively. For a retail operation with a large product catalog, a POS system that automates inventory reconciliation after each sale is transformative.

Once you have determined the right hardware setup, the next step is finding a provider that won’t eat into your margins. We analyzed the market to help you save money in our post: Card Machine Price: A Definitive 2026 Guide to the Lowest Fees.

The Card Payment Process in South Africa

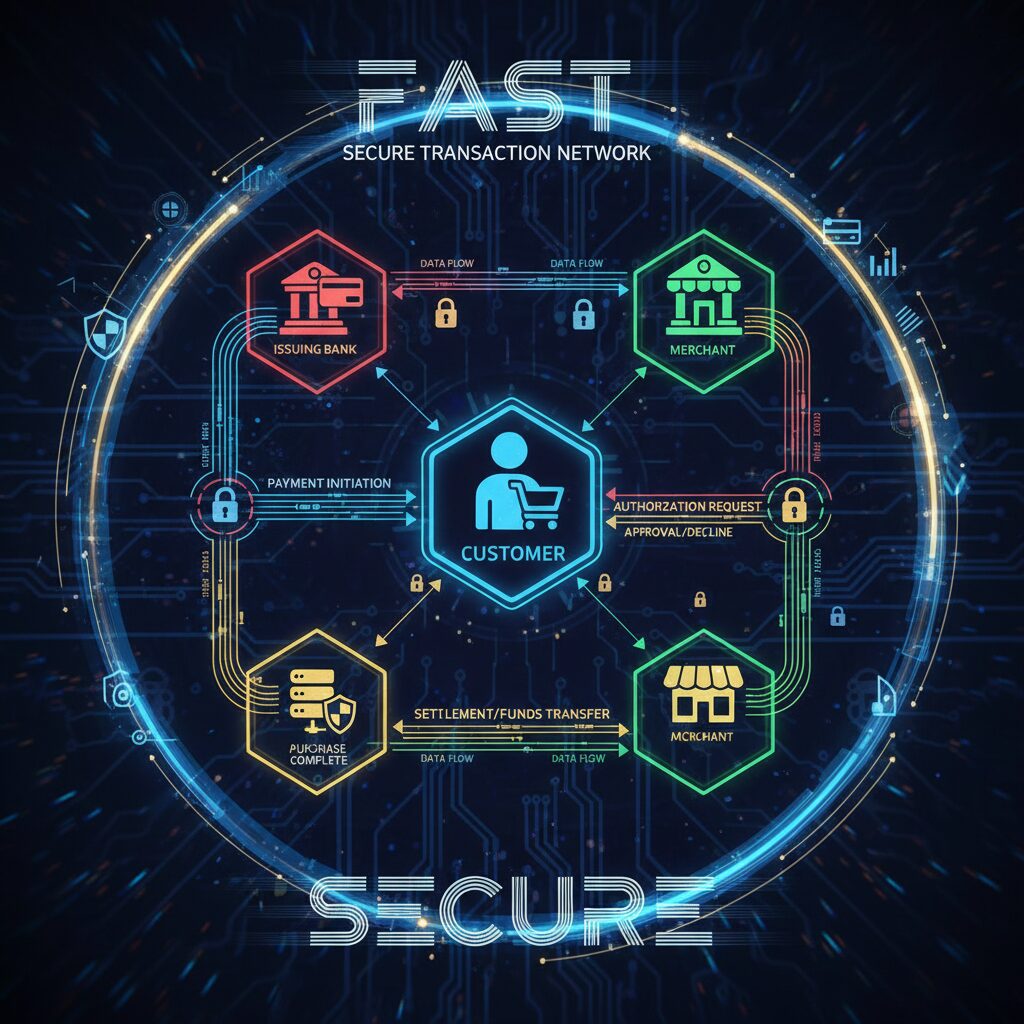

Each card transaction initiates a secure, high-speed process. This framework, known as the “four-party model,” ensures transactional integrity and facilitates the transfer of funds from the customer’s account to the merchant’s account.

The four principal parties involved are:

- The Customer: The cardholder initiating the purchase.

- The Issuing Bank: The customer’s financial institution that issued the card (e.g., Capitec, FNB).

- The Acquiring Bank: The merchant’s bank or payment service provider (e.g., Yoco, iKhokha, Standard Bank) that supplies the payment terminal and processes the transaction.

- The Merchant: Your organization.

As detailed in this article on how card payments work in South Africa, the process is executed in real-time:

- Initiation: The transaction value (e.g., R150) is entered into the POS system or payment terminal.

- Authentication: The customer presents their card via tap, insertion, or swipe. The device encrypts the card data and transmits a secure authorization request to the acquiring bank.

- Authorization: The acquirer forwards the request through the relevant card network (e.g., Visa, Mastercard) to the customer’s issuing bank. The issuer verifies available funds and either approves or declines the request.

- Confirmation: An approval or decline message is relayed back to the terminal. Upon approval, the transaction is confirmed, and a receipt is generated (printed or digital).

- Settlement: At the close of business, all approved transactions are batched for settlement. The acquiring bank transfers the total funds, less applicable transaction fees, to the merchant’s business account.

For organizations utilizing an integrated POS system, this process delivers greater value. Concurrent with transaction approval, the system automatically updates inventory levels, ensuring stock data is consistently accurate.

This automated workflow is integral to operational efficiency. But efficiency often requires mobility—being able to take the payment directly to the customer. We break down the pros and cons of going wireless in Mobile Card Machine vs. Bank Terminal: Is a Portable Card Machine Better? (2026 Guide.

A Comparative Analysis: Fintech vs. Traditional Banking Solutions

The South African payment solutions market features prominent fintech providers, such as Yoco and iKhokha, alongside traditional banking institutions. Each presents distinct advantages aligned with specific business requirements.

Fintech Providers: Yoco & iKhokha

Yoco and iKhokha have transformed the local market by delivering accessible, cost-effective, and streamlined payment acceptance solutions for small and medium-sized enterprises (SMEs).

Strengths:

- Rapid Deployment: Solutions involve a once-off hardware purchase with simplified onboarding, enabling organizations to become operational within days.

- Pay-Per-Transaction Model: The standard model eliminates monthly fees, comprising a single hardware cost and a competitive per-transaction rate. This aligns costs directly with revenue generation.

- Mobility and Agility: Their hardware is engineered for modern, mobile business models.

- Integrated Software: Both provide software with foundational sales analytics, while Yoco offers an advanced POS system that includes comprehensive inventory and staff management modules.

Weaknesses:

- Rate Structure: For enterprises with exceptionally high transaction volumes, a pay-per-transaction fee structure may be less cost-effective than a negotiated custom rate from a traditional bank.

- Enterprise Scalability: These solutions may not meet the complex integration and large-scale deployment requirements of national enterprise clients.

These providers are optimal for startups, mobile vendors, cafés, boutiques, and any SME requiring a straightforward, cost-effective payment platform.

That said, success requires more than just taking payments; you also need to manage the data behind them. For a step-by-step tutorial on accessing your sales history and settlement reports, check out Yoco Business Portal: The Definitive Guide to Yoco Login (2026).

Traditional Banks (FNB, Standard Bank, etc.)

Established financial institutions have historically been the traditional choice for payment processing, offering services integrated with a corporate bank account.

Strengths:

- Unified Banking Ecosystem: All processes, from transaction authorization to final settlement, are managed within a single banking relationship.

- Optimized for High Volume: Can provide superior cost-efficiency for large enterprises with high monthly transaction volumes through negotiated, customized rate structures.

- Robust Hardware: Offer durable, traditional terminals engineered for high-traffic, fixed-location retail environments.

Weaknesses:

- Cost Structure and Contracts: Typically involve monthly hardware rental fees and may require long-term contractual commitments.

- Reduced Agility: Onboarding processes can be protracted, and the technology is often less agile and mobile-centric compared to fintech solutions.

- Pace of Innovation: Slower to adopt technological advancements such as cloud-based analytics and seamless third-party software integrations.

Traditional banks are generally more suitable for established, high-volume enterprises that can leverage their scale to secure preferential rates and value a consolidated banking partnership.

Selecting the Optimal Solution for Your Organization

Selecting the correct POS system or card machine depends on your organization’s specific operational requirements:

- For mobile vendors and startups: A pay-per-transaction card machine from Yoco or iKhokha represents an ideal entry-level solution.

- For growing retail or hospitality businesses: An integrated Yoco POS system provides an optimal balance of streamlined payment processing and robust tools to manage inventory, personnel, and sales analytics.

- For large, established enterprises: A traditional bank solution may offer the most cost-effective framework for managing exceptionally high transaction volumes, provided the organization is prepared for long-term contracts and less agile technology.

By understanding the technology and the leading providers, you are now equipped to select a payment solution that aligns with your financial parameters and empowers your organization for sustained growth in South Africa’s dynamic economic landscape.

Where Eezipay fits Beyond just “Taking Payments”

If your goal is to simply swipe a card, basic tools work well—up to a point. But once you need to manage complex operations like inventory across multiple locations, school fee collections, or staff-level reporting, you’ll get better results with a system that combines payments + POS + management in one place.

That’s where Eezipay fits—offering high-performance Smart POS and Touch POS solutions designed for businesses that need deep operational control and South African-based support.

To help you make the best decision, view the Eezipay Smart POS vs. Touch POS — See which physical setup best fits your counter or mobile environment.