Finding the best payment gateway South Africa has to offer is a critical decision for any organization with an online presence. This technology empowers your organization to securely accept payments from customers, directly impacting your cash flow, customer trust, and operational efficiency. A payment gateway functions as the critical digital infrastructure connecting your website, your customer, and the relevant financial institutions, ensuring sensitive financial data is managed with precision and transactions are processed efficiently.

In South Africa, the landscape comprises a dynamic mix of local and international providers, including PayFast, Peach Payments, Paystack, Yoco, DPO PayGate, Netcash, and PayU. This guide provides a comprehensive overview of their operational mechanics, from underlying technology to security protocols and integration methods, to empower you to make an informed decision for your organization.

The Payment Gateway South Africa Processing Framework

A payment gateway automates the transfer of funds between your customer’s bank and your organization’s bank account. While the process appears instantaneous to the end-user, a complex sequence of events occurs behind the scenes, involving several principal entities.

Principal Entities in the Transaction Lifecycle

- The Customer: The individual initiating the payment on your website or application.

- The Merchant: Your organization, the recipient of the funds in your South African bank account.

- The Payment Gateway: The technology provider that securely captures the customer’s payment details and routes the information to the relevant financial institutions.

- The Acquiring Bank: The merchant’s bank, which acquires the funds from the customer’s bank.

- The Issuing Bank: The customer’s bank, which issues their credit/debit card or holds their account funds.

- Card Schemes & Payment Rails: The networks (e.g., Visa, Mastercard) or systems (e.g., Instant EFT) that establish the rules and provide the infrastructure for the transaction.

The Standard Card Transaction Lifecycle

When a customer purchases a product on your Shopify or WooCommerce platform, the payment gateway facilitates the following sequence:

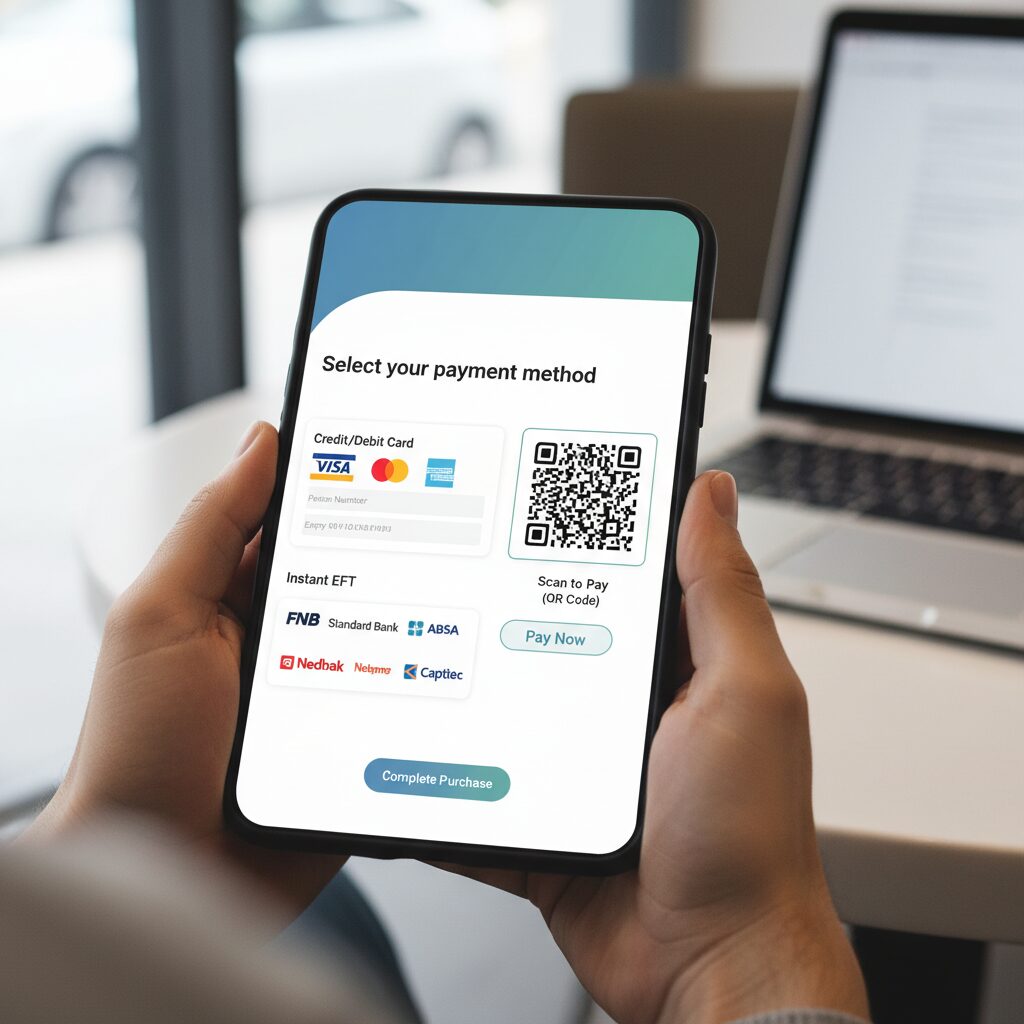

- Checkout: The customer adds items to their cart and navigates to the checkout portal, where they select “Credit/Cheque Card” and input their card details (number, expiry date, CVV).

- Secure Data Capture: The payment gateway securely captures these details. Utilizing a hosted payment page ensures this data does not traverse your server, which significantly reduces your security and compliance obligations.

- Encryption & Routing: The gateway encrypts the transaction information and sends it to the acquiring bank and then on to the relevant card scheme (e.g., Visa).

- Authorisation Request: The card scheme routes the request to the customer’s issuing bank for verification of fund availability and card validity.

- Fraud & Security Checks: During this process, 3-D Secure (such as “Verified by Visa” or “Mastercard SecureCode”) is typically initiated. This requires the customer to authenticate the transaction via a One-Time PIN (OTP) or an approval in their banking application, providing a critical layer of security.

- Authorisation Response: The issuing bank transmits an approval or decline response back through the transaction chain to the payment gateway.

- Confirmation & Settlement: The gateway relays this outcome to your platform. If approved, the order is confirmed. Funds are subsequently settled from the issuing bank to the acquiring bank and deposited into your merchant account, generally within a 1-3 business day timeframe.

Key Alternative Payment Methods in South Africa

While card payments are prevalent, South Africa features a diverse payment ecosystem. A robust gateway must support the payment methods preferred by your customer base. As detailed in a recent Netcash report on top payment methods, providing comprehensive payment options is critical for maximizing conversions.

- Instant EFT: Services like Ozow and SiD Secure EFT enable customers to execute a direct bank transfer from their online banking profile. The gateway provides real-time payment confirmation to the merchant, which eliminates settlement delays and mitigates fraud risk.

- QR Codes & Digital Wallets: The proliferation of mobile devices makes QR-based payments from applications like Zapper, SnapScan, and Masterpass integral to a modern payment strategy. Customers scan a code to authorize payment using card details securely stored within their digital wallet.

- Buy Now, Pay Later (BNPL): Providers such as PayJustNow and Payflex integrate with gateways to allow customers to pay for purchases in interest-free instalments. This functionality can significantly increase conversion rates, particularly for higher-value transactions.

- Prepaid Vouchers: To serve unbanked customers or those preferring cash-based transactions, services like 1Voucher and OTT Voucher allow them to purchase a voucher with a PIN at a physical retailer and redeem it on your website.

- PayShap: This new payment rail enables real-time, low-cost payments between participating banks using a mobile number (ShapID). Its integration into gateway platforms is expanding, offering an efficient payment alternative.

Security and Compliance in the South African Payment Landscape

For any organization, security is non-negotiable. The acceptance of online payments necessitates the management of sensitive customer data; a security breach can result in severe reputational and financial damage. A secure payment gateway is fundamental to mitigating these risks.

Foundational Security Protocols

- PCI DSS (Payment Card Industry Data Security Standard): This is the global security standard for any organization that accepts card payments. Leading South African gateways like DPO PayGate, Peach Payments, and PayFast are certified PCI DSS Level 1 Service Providers—the highest level of compliance. By utilizing their hosted payment pages, you delegate the majority of this compliance responsibility.

- Tokenization: This process substitutes sensitive card details with a unique, non-sensitive identifier known as a “token.” The token can be securely stored and utilized for subsequent transactions (such as one-click checkouts or recurring subscriptions) without exposing the primary account number.

- 3-D Secure: This mandatory security layer in South Africa is designed to prevent fraudulent transactions by requiring cardholder authentication with their bank. It significantly reduces merchant liability and the risk of chargebacks.

- Encryption: All data transmitted between the customer’s browser, your website, and the payment gateway must be encrypted using Transport Layer Security (TLS). This protocol ensures that information cannot be intercepted and compromised by unauthorized parties.

Security Focus: DPO PayGate

DPO PayGate is an established and trusted payment gateway in South Africa, positioned as an enterprise-grade solution for organizations requiring robust security and advanced features.

PayGate’s security infrastructure is engineered to manage high volumes and complex requirements. It offers:

- Advanced Fraud Screening: Beyond standard 3-D Secure, PayGate provides advanced rule-based filters, velocity checks, and blacklisting capabilities to identify and mitigate potentially fraudulent transactions before processing.

- Tokenization for Subscriptions: Through its PaySubs module, PayGate excels at managing recurring payments and subscriptions. Its secure tokenization of card details makes it an ideal solution for SaaS companies, membership-based organizations, and businesses with a recurring revenue model.

- Enterprise Focus: PayGate’s custom pricing and feature set are engineered for larger organizations requiring granular control, comprehensive reporting, and dedicated support for risk management.

Payment Gateway Integration Strategies for South African Businesses

Implementing a payment gateway can be a streamlined process, with a variety of integration methods available to accommodate different levels of technical expertise.

Standard Integration Models

- Hosted Payment Page (Redirect): This is the most direct and widely used method. The customer is redirected from the merchant’s website to a secure payment page hosted by the gateway (e.g., PayFast or PayU) to enter their payment details. Post-transaction, the customer is returned to a designated confirmation page.

- Pros: Streamlined and rapid deployment; highest level of security and simplified PCI compliance.

- Cons: The user experience involves a temporary navigation away from the primary site.

- Embedded Form (iFrame): This provides a balanced approach to user experience and security. The payment form is rendered directly on the merchant’s checkout page but is contained within an iFrame hosted by the gateway. This architecture allows the customer to remain on the site while ensuring sensitive data is transmitted directly to the gateway’s secure servers.

- Direct API Integration: For organizations with dedicated development resources, a direct API integration provides maximum control and customisation. This allows for the development of a fully bespoke payment experience within your website or mobile application. This approach necessitates a significantly greater PCI compliance scope for the merchant. As noted in this guide on choosing a gateway, developer-centric APIs from providers like Peach Payments and Paystack are highly advantageous for this integration model.

Platform Plugins: An Expedited E-commerce Solution

Many South African organizations utilize leading e-commerce platforms. Fortunately, all major local gateways provide pre-built, complimentary plugins for:

- WooCommerce (for WordPress)

- Shopify

- Magento (Adobe Commerce)

- Wix

Plugin installation is typically a streamlined process. It automatically integrates the payment gateway with the e-commerce store, populates payment options at checkout, and manages order status updates based on transaction outcomes.

Managing Recurring Payments and Subscriptions

For organizations with a subscription or membership-based revenue model, selecting a gateway with robust recurring billing functionality is essential.

- Token-Based Recurring: Gateways like Peach Payments and Paystack leverage tokenization to facilitate this. The initial transaction generates a secure token, which the merchant’s system can then use to initiate subsequent charges automatically on a weekly, monthly, or annual basis.

- Gateway + Debit Orders: For certain business models (such as schools, fitness centers, or B2B services), the conventional debit order system remains highly relevant. A provider like Netcash is distinguished by offering both a modern payment gateway and a robust debit order collection system within an integrated platform, enabling centralized management of all revenue streams.

Selecting the Optimal Payment Gateway for Your Organization

Given the array of high-quality solutions available, the optimal payment gateway for your organization in South Africa is determined by your specific operational requirements. Evaluate the following factors:

- Your Business Model: Your operational model—whether e-commerce, subscription service, marketplace, or B2B invoicing—will dictate the necessity of features such as recurring billing, split payments, or debit order functionalities.

- Your Sales Volume: Certain gateways are optimized for startups (e.g., PayFast with no monthly fees), whereas others are engineered for high-volume enterprises (e.g., DPO PayGate with custom pricing).

- Your Customers’ Preferences: Analyze the payment preferences of your target demographic. Select a gateway that supports the methods most utilized by your customer base, such as card, Instant EFT, or QR codes.

- Your Technical Resources: Evaluate your in-house technical capabilities. Determine if you require a simple plugin-based solution or possess the development resources to manage a direct API integration.

- The Full Cost: Analyze the total cost of ownership beyond the headline transaction fee. Account for any setup fees, monthly service charges, or ancillary costs for different payment methods or chargebacks. Calculate the projected total cost based on anticipated transaction volume and average transaction value. A successful enterprise requires a comprehensive omnichannel sales strategy, detailed in our guide Best Payment Gateway South Africa: An Ultimate Guide to the Top 5 Online Payment Methods that seamlessly integrates both online and physical payment streams.

By methodicallhttps://eezipay.com/?p=284484y evaluating these factors against the solutions offered by providers like PayFast, Peach Payments, Paystack, and PayGate, you can select a strategic partner that not only processes payments but also facilitates sustained business growth.