The educational landscape in South Africa, much like the rest of the world, is undergoing a profound transformation. Beyond the curriculum and classroom, the very operational backbone of schools and universities – particularly their financial systems – is evolving at an unprecedented pace. For too long, finance teams have been burdened by manual reconciliations, security risks associated with cash, and the administrative drain of chasing late payments. This is where the future arrives. At the heart of this revolution lie Artificial Intelligence (AI) and automation, promising a future where school payments are not just efficient but also secure, transparent, and seamlessly integrated into the daily lives of parents and staff.

This article explores the transformative impact of AI and automation on financial management within South African educational institutions. We will delve into the global and local trends driving this change, establish why a cashless environment is the essential foundation, and unpack the specific roles AI and automation play in everything from fraud detection to predictive analytics.

For bursars, university finance teams, and school administrators across the nation, understanding this shift isn’t just beneficial; it’s imperative for building resilient, future-proof institutions that can thrive in a digital-first world.

Table of Contents

A Shifting Paradigm: Global and Local Payment Trends

Globally, the move towards digital and cashless transactions has been a dominant trend for over a decade. Spurred by technological advancements and the convenience they offer, consumers and institutions alike are increasingly abandoning physical cash. In the education sector, this translates to a growing demand for streamlined payment processes for tuition, fees, extracurricular activities, and sundry expenses.

South Africa, with its unique socio-economic landscape, presents both challenges and opportunities in this digital migration. While cash remains prevalent in certain communities, there is a clear and accelerating shift towards digital payment methods, particularly in urban and peri-urban areas.

According to PwC, digital payments in South Africa are projected to grow significantly, driven by mobile and internet penetration, and by policy efforts aimed at increasing financial inclusion. In this local context, adopting advanced payment solutions powered by AI and automation is no longer optional but a strategic imperative for educational institutions that need to serve a diverse student and parent population efficiently. The COVID-19 pandemic further accelerated this trend, highlighting the vulnerabilities of cash-dependent systems and the resilience of digital alternatives.

Cashless as the Cornerstone: Why It’s the Foundation of Future Payments

Before delving into the sophisticated roles of AI and automation, it’s crucial to establish why cashless school payments are the fundamental building block for the future of school payments. The benefits are multifaceted:

- Enhanced Security: Carrying large sums of cash on school premises poses significant security risks, making institutions targets for theft. Cashless systems drastically reduce this risk, protecting both funds and individuals.

- Increased Transparency and Accountability: Every digital transaction leaves a clear audit trail. This transparency is invaluable for financial oversight, reconciliation, and reporting, significantly reducing opportunities for misappropriation.

- Greater Efficiency: Manual cash handling is time-consuming, prone to human error, and resource-intensive. AI and automation enhance cashless systems by automating reconciliation, reducing administrative burden, and freeing up staff for strategic tasks.

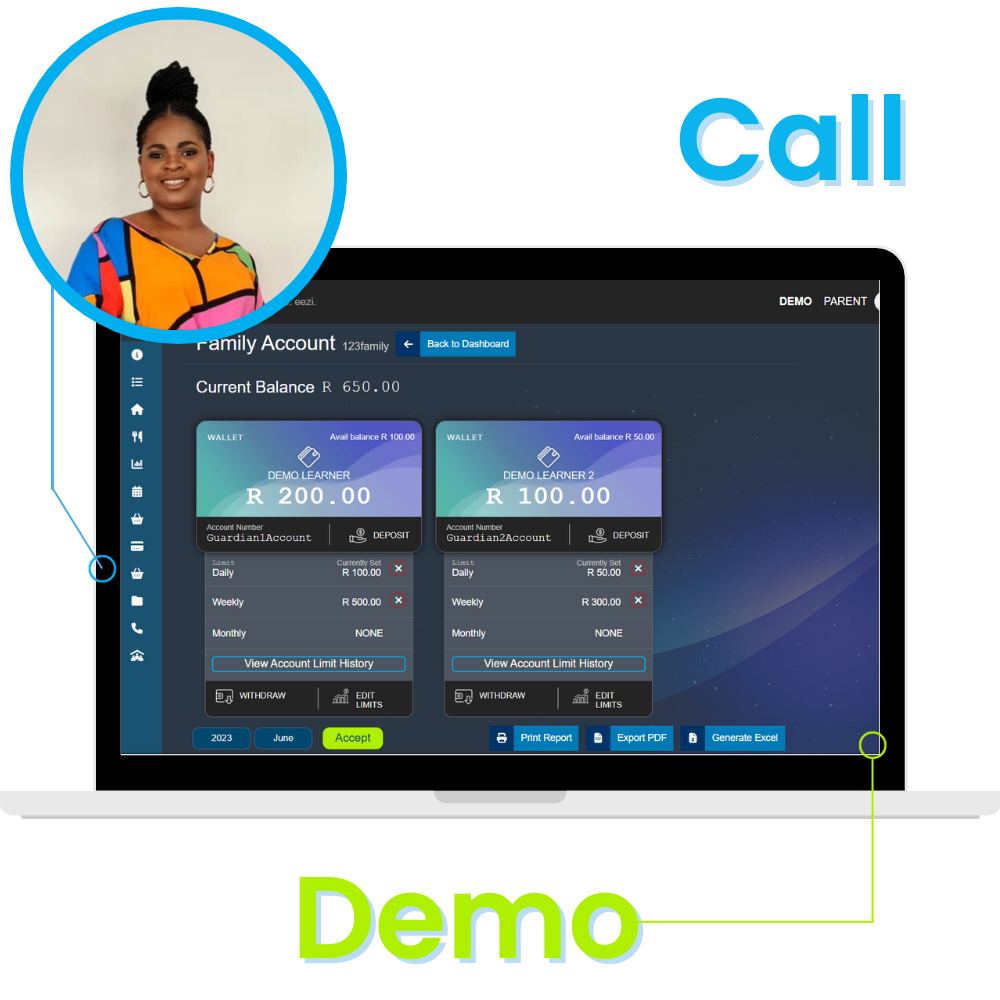

- Improved Convenience and Accessibility: Parents can make payments anytime, anywhere, using various digital channels, including mobile apps, EFTs, and online portals. This flexibility is particularly important for busy parents and those residing in different locations.

- Hygiene and Health: As the recent pandemic underscored, handling physical cash can be unhygienic, facilitating the spread of germs. Cashless payments offer a cleaner, safer alternative.

For South African schools and universities, transitioning to a cashless environment is not merely about adopting a new technology; it’s about modernising operations, enhancing safety, and aligning with global best practices. It sets the stage for the true potential of AI and automation to be unleashed.

The Power Duo: AI and Automation in Action

Once a robust cashless system is in place, AI and automation move beyond mere efficiency to offer transformative advantages. These technologies are not just about making existing processes faster; they’re about reimagining how financial operations are conducted, making them smarter, more secure, and inherently more proactive.

AI tools can help in several ways—by automating or assisting with functions that are laborious or error-prone if handled manually. Here are key capabilities, and what administrators should look for.

Automation: Streamlining the Mundane

Automation, in the context of automated school payments, refers to the use of technology to perform tasks with minimal human intervention. This includes:

- Automated Invoicing and Reminders: Generating and dispatching invoices, sending payment reminders via SMS or email, and tracking due dates can all be automated. This ensures timely communication and reduces the likelihood of late payments.

- Payment Reconciliation: One of the most laborious tasks in school finance is reconciling incoming payments with individual student accounts. Automated systems can match payments to invoices instantly, flagging discrepancies and significantly reducing manual effort.

- Reporting and Analytics: Generating financial reports, cash flow statements, and budget analyses can be automated, providing real-time insights into the institution’s financial health.

- Integration with Existing Systems: Modern automated payment platforms can integrate seamlessly with Student Information Systems (SIS), Enterprise Resource Planning (ERP) systems, and accounting software, creating a unified data ecosystem.

The immediate benefit of AI and automation is a dramatic reduction in administrative overhead. Finance teams can shift their focus from repetitive data entry to strategic financial planning and student support.

Artificial Intelligence: The Brain Behind the Operations

While automation handles the ‘doing,’ AI provides the ‘thinking.’ AI algorithms can learn from data, identify patterns, and make informed decisions, bringing a new level of sophistication to school finance.

- Fraud Detection and Prevention: This is where AI truly shines. Traditional fraud detection relies on rules-based systems, which can be rigid and easily circumvented. AI, using machine learning, can analyse vast amounts of transaction data in real-time to identify anomalous patterns indicative of fraudulent activity. For example, it can detect unusual payment amounts, frequent changes in payment methods for the same account, or attempts to pay from high-risk locations. By continuously learning from new data, AI models become increasingly adept at spotting sophisticated fraud attempts before they cause significant damage. This is particularly crucial for South African institutions, where AI and automation together create a more resilient defence against financial crime.

- Predictive Analytics for Payment Behaviour: AI can analyse historical payment data to predict future payment trends and potential defaulters. This allows institutions to proactively engage with parents who might struggle to make payments, offering flexible payment plans or support, rather than reacting to late payments. This proactive approach can significantly improve cash flow and reduce arrears.

- Personalised Communication and Support: AI-powered chatbots can handle routine parent queries about outstanding balances, payment options, and fee structures, providing instant responses 24/7. This frees up administrative staff and enhances parent satisfaction.

- Optimised Resource Allocation: By analysing financial data and operational costs, AI can help institutions identify areas for cost savings and optimise resource allocation, ensuring funds are directed where they can have the greatest impact on education.

Traditional vs. AI/Automated School Payments: A Comparative Overview

To illustrate the stark contrast, consider the following comparison:

| Feature | Traditional School Payments | AI and Automated School Payments |

|---|---|---|

| Payment Methods | Cash, cheque, manual EFT, card machines | Online portals, mobile apps, secure EFT, debit order, card, crypto (emerging) |

| Security | High risk of cash theft, limited fraud detection | Reduced physical risk, AI-driven real-time fraud detection |

| Efficiency | Manual data entry, slow reconciliation, prone to errors | Automated invoicing, instant reconciliation, minimal human error |

| Transparency | Manual record keeping, potential for discrepancies | Digital audit trails, real-time access to financial data |

| Parent Convenience | Limited payment times, physical visits required | 24/7 online payments, multiple convenient options |

| Administrative Burden | High, staff time spent on cash handling and reconciliation | Low, staff focus on strategic tasks, automated processes |

| Reporting & Analytics | Manual, historical data, time-consuming | Real-time, AI-powered insights, predictive analysis |

| Error Rate | Moderate to high | Significantly low due to automation |

| Proactive Management | Reactive to issues like late payments | Proactive fraud prevention, predictive payment behaviour |

| Scalability | Difficult to scale with increasing student numbers | Easily scalable to accommodate growth |

This comparison shows that AI and automation go beyond simple upgrades, offering smarter, more secure, and scalable school payment systems for South African institutions.

Navigating the Transition: Practical Steps for South African Institutions

Implementing AI and automation in school payments might seem daunting, but a phased approach can make the transition smooth and effective.

- Assess Current Systems: Understand existing payment processes, identifying bottlenecks, pain points, and areas ripe for automation.

- Embrace Cashless First: Prioritise the transition to a comprehensive cashless system. This involves educating parents, providing multiple digital payment options, and ensuring robust security protocols. For more insights on this foundational step, consider reading about the benefits of cashless systems for schools and how they lay the groundwork for future innovations.

- Choose the Right Partner: Select a technology partner with a proven track record in the education sector and a deep understanding of the South African context. Look for solutions that offer scalable automation features built on AI and automation for enhanced security and insights.

- Phased Implementation: Start with automating core processes such as invoicing and reconciliation, then gradually introduce more advanced AI functionalities such as fraud detection.

- Training and Support: Provide adequate training for finance teams and administrators to ensure they are comfortable and proficient with the new systems. Ongoing support is crucial for successful adoption.

- Data Security and Compliance: Ensure all systems comply with data protection regulations such as POPIA in South Africa. Data privacy and security must be paramount.

Beyond Payments: The Broader Impact on Education

The benefits of advanced payment systems extend far beyond the finance department. When administrative burdens are lightened and financial operations are secure, educational institutions can reallocate resources and focus more intently on their core mission: educating students.

- Enhanced Student Experience: Less time spent on payment-related issues means more focus on academics and student support.

- Better Resource Allocation: Freed-up funds and personnel can be directed towards improving facilities, investing in educational technology, or supporting disadvantaged students through bursaries.

- Enhanced Reputation: Institutions that demonstrate financial prudence, technological advancement, and a commitment to security will attract more students and faculty.

- Strategic Decision Making: Real-time data and AI-powered insights empower leadership to make more informed and strategic decisions about the institution’s future.

Looking Ahead: The Fully Intelligent Campus

The journey towards fully automated and AI-driven financial systems is part of a larger vision for an “intelligent campus.” Imagine a future where bursary allocations are not just processed but intelligently matched to student needs based on predictive analytics, ensuring equitable access to education. Consider how fraud in procurement and other financial areas could be drastically reduced through continuous AI monitoring.

In this future, the finance department evolves from a reactive processing unit to a proactive strategic partner, leveraging data to drive institutional success. The emphasis on AI and automation isn’t just about efficiency; it’s about building resilient, transparent, and forward-thinking educational institutions that are well-equipped to face the challenges of the 21st century. For South African schools and universities, embracing this technological wave is not an option but a necessity. The future of school payments is digital, automated, and intelligent, promising a more secure and streamlined educational experience for all stakeholders. To further explore the benefits of digital transformation for your institution, read this article about 8 important reasons for educational institutions to go cashless.

The opportunity to transform financial operations and, by extension, the entire educational ecosystem, is here. By strategically adopting AI and automation, South African institutions can lead the way in creating a more efficient, secure, and accessible learning environment for generations to come.