For finance leaders in South Africa’s education sector, the landscape in 2025 is more complex than ever. Navigating tight budgets, rising operational costs, and the economic pressures felt by families requires more than just meticulous bookkeeping; it demands strategic foresight. The role of the bursar and the university finance team has fundamentally shifted from being historical record-keepers to forward-looking financial strategists. In this new era, Artificial Intelligence (AI) in finance has emerged not as a futuristic buzzword but as a practical, powerful ally.

While many institutions have made commendable strides in digital transformation, the conversation is now moving beyond simply processing transactions to generating intelligence from them. AI in finance is fundamentally reshaping core operations—from budgeting and compliance to fraud detection and reporting—making them more efficient, predictive, and secure.

This article serves as a definitive guide for South African educational finance leaders. We will explore the tangible applications of AI in finance, demystify how it works in an education context, and outline the critical first steps your institution must take to leverage this transformative technology. The goal is not merely to survive the financial challenges of 2025, but to thrive by building a truly intelligent finance function.

Table of Contents

The Foundation: Why a Cashless Campus is the Launchpad for AI

Before we delve into the sophisticated capabilities of AI in finance, we must address a foundational truth: AI runs on data. The quality, quantity, and accessibility of your financial data will directly determine the success of any AI implementation. This is where manual, cash-based systems fall short.

Cash transactions and disjointed manual processes create “dirty data”—information that is unstructured, inconsistent, and often locked away in paper files or disparate spreadsheets. Attempting to build an AI strategy on such a foundation is like trying to construct a skyscraper on a swamp. It is destined to fail.

This is precisely why the journey towards becoming one of the many cashless schools in South Africa is the non-negotiable first phase of any AI strategy. By digitising payments, you are not just improving convenience and security; you are creating a clean, consistent, and centralised stream of data. Every digital transaction—from school fees and tuck shop purchases to event tickets and uniform sales—becomes a structured data point ready for AI in finance applications.Platforms that offer integrated school payments are crucial here. They consolidate data from various payment channels (EFT, card, mobile apps) into a single, unified ledger. This unified dataset is the rich, fertile ground from which AI can derive powerful insights. Without this digital foundation, AI models have nothing to analyse, and their potential remains untapped.

Before we delve into the sophisticated capabilities of AI in finance, we must address a foundational truth: AI runs on data. The quality, quantity, and accessibility of your financial data will directly determine the success of any AI implementation. This is where manual, cash-based systems fall short.

Cash transactions and disjointed manual processes create “dirty data”—information that is unstructured, inconsistent, and often locked away in paper files or disparate spreadsheets. Attempting to build an AI strategy on such a foundation is like trying to construct a skyscraper on a swamp. It is destined to fail.

This is precisely why the journey towards becoming one of the many cashless schools in South Africa is the non-negotiable first phase of any AI strategy. By digitising payments, you are not just improving convenience and security; you are creating a clean, consistent, and centralised stream of data. Every digital transaction—from school fees and tuck shop purchases to event tickets and uniform sales—becomes a structured data point ready for AI in finance applications.Platforms that offer integrated school payments are crucial here. They consolidate data from various payment channels (EFT, card, mobile apps) into a single, unified ledger. This unified dataset is the rich, fertile ground from which AI can derive powerful insights. Without this digital foundation, AI models have nothing to analyse, and their potential remains untapped.

AI in Finance: Revolutionising Core Financial Operations

With a solid digital data foundation in place, educational institutions can begin to unlock the true power of AI across their most critical financial functions. Here is how AI is making a tangible impact in 2025.

1. Predictive Budgeting and Forecasting

Traditional budgeting is often a static, rearview mirror exercise, typically based on the previous year’s figures with a minor adjustment for inflation. This approach is notoriously fragile, leaving institutions vulnerable to unforeseen economic shifts or changes in enrolment.

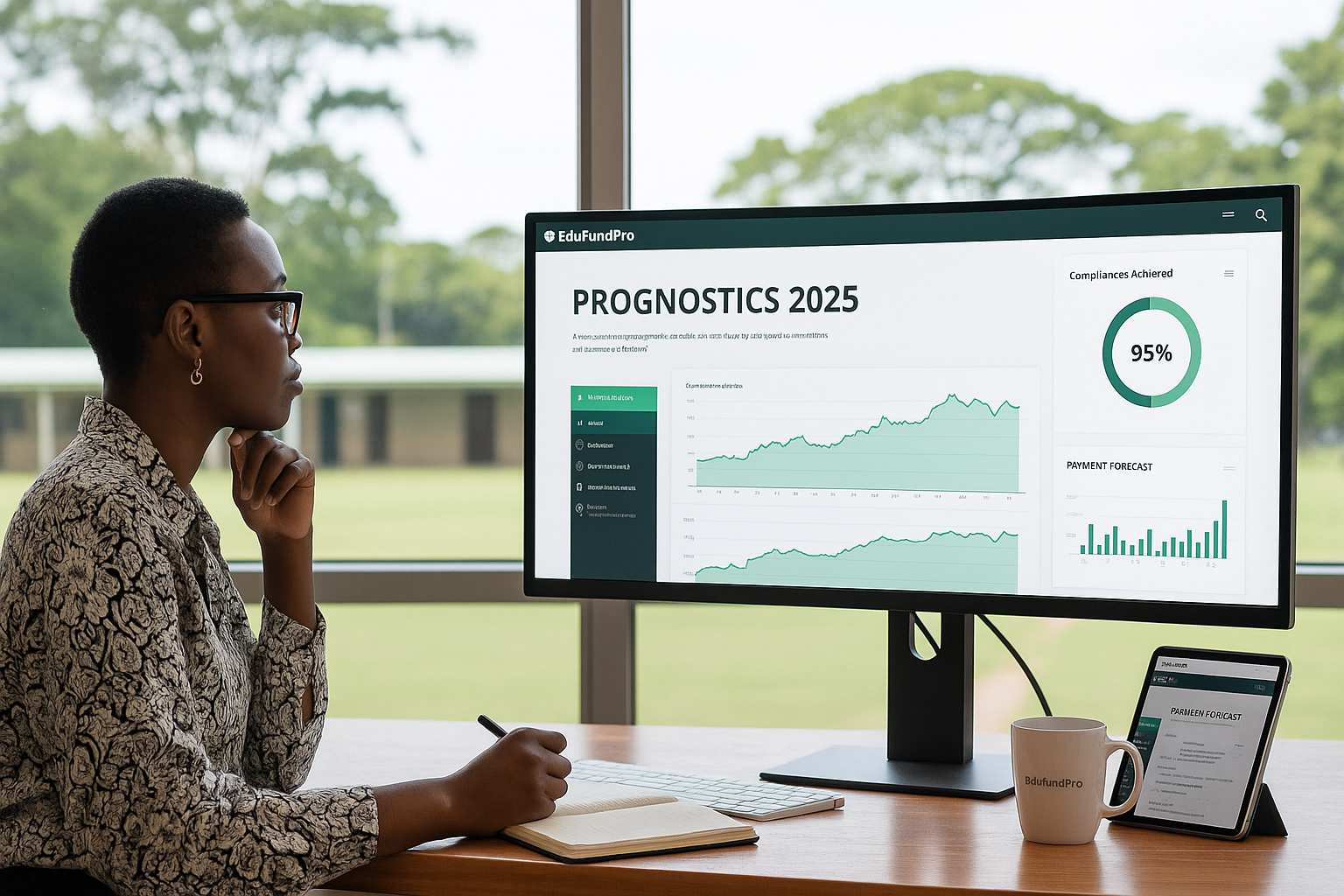

The AI in Finance Solution: AI transforms budgeting from a reactive ritual into a dynamic, predictive science. By analysing years of internal financial data alongside external factors—such as national inflation forecasts from the South African Reserve Bank and regional demographic shifts—machine learning models can generate far more accurate and resilient financial forecasts.

Imagine an AI system that predicts a potential 5% drop in fee collections for the third term based on historical payment lags and current consumer economic indicators. Armed with this foresight, a bursar can proactively adjust spending, arrange a short-term credit facility, or implement a targeted communication campaign to at-risk families, thereby protecting the institution’s cash flow. As noted by Deloitte, AI is shifting finance teams from explaining “what happened” to predicting “what will happen,” enabling truly strategic decision-making.

2. Streamlining Compliance and Reporting

The administrative burden of generating financial reports and ensuring compliance with regulations like the Protection of Personal Information Act (POPIA) is a significant drain on a finance team’s resources. Manual processes are not only slow but also introduce the risk of human error, which can have serious compliance implications.

The AI in Finance Solution: AI-driven bursar finance automation tools can produce complex financial reports in minutes, not days. These systems can automatically consolidate data, identify trends, and flag anomalies that require human investigation.

For compliance, AI offers a powerful layer of oversight. It can monitor data access patterns and transaction flows in real time, automatically flagging any activity that deviates from established POPIA or internal governance policies. This creates an immutable, automated audit trail, significantly simplifying compliance checks and reducing institutional risk. Given the rising complexity of the global regulatory landscape, as highlighted in PwC’s 2024 Global Economic Crime and Fraud Survey, leveraging technology for compliance is no longer an option but a necessity.

3. Proactive Fraud Detection

Traditional fraud detection methods are often rule-based (e.g., “flag any payment over R50,000 to a new supplier”). These systems are easy for sophisticated fraudsters to circumvent and typically only catch fraudulent activity after the money has already left the institution’s account.

The AI in Finance Solution: AI takes a fundamentally different, more intelligent approach. Instead of relying on rigid rules, machine learning algorithms are trained to understand the unique, “normal” pattern of financial behaviour for your specific institution. This includes who you pay, when you pay them, how much you pay, and from which devices these payments are approved.

Any deviation from this established norm is instantly flagged as a potential threat. For example, an could detect and flag a series of small, seemingly insignificant payments to a new bank account late at night—a pattern indicative of certain types of internal fraud that would be invisible to a rule-based system. This enables proactive intervention, preventing fraud before a significant financial loss occurs.

4. Intelligent Automation of Invoicing and Reconciliation

One of the most time-consuming tasks in any school or university finance office is payment reconciliation. Manually matching thousands of parent payments, often with vague or incorrect reference numbers like “School fees” or “Jabu Grd 5,” to the correct student accounts is a significant administrative bottleneck.

The AI in Finance Solution: This is where AI, particularly Natural Language Processing (NLP), delivers immediate and substantial value. AI-powered reconciliation tools can intelligently interpret inconsistent payment references. The system learns to associate “Jabu S fees,” “J. Smith Gr5,” and an ID number with the student Jabu Smith in Grade 5. According to research from McKinsey, intelligent automation can reduce the time spent on such manual data processes by over 50%, freeing up staff to focus on higher-value work like parent engagement and strategic financial planning.

Manual vs. AI-Powered Finance: A Practical Comparison

The theoretical benefits of AI in finance are compelling, but what does the change look like in day-to-day operations? The table below illustrates the practical shift from traditional financial tasks to their AI-powered counterparts.

| Financial Task | Traditional / Manual Approach | AI-Powered Approach |

|---|---|---|

| Fee Reconciliation | Manually matching line items from bank statements to student ledgers. Time-consuming and error-prone. | Automated matching using pattern recognition and NLP, even with incorrect references. Over 95% accuracy. |

| Budget Forecasting | Based on last year’s figures, plus a flat percentage increase. Static and slow to adapt. | Dynamic, real-time forecasting based on historical data, enrolment trends, and economic indicators. |

| Fraud Detection | Reactive investigation after a fraudulent transaction has occurred. Relies on periodic manual audits. | Proactive, real-time anomaly detection that flags suspicious activity before significant loss occurs. |

| Parent Queries | Staff manually answer repetitive emails and calls about balances and payment methods during office hours. | 24/7 AI-powered chatbot handles common queries instantly, freeing up staff for complex issues. |

| Financial Reporting | Manual compilation of data in spreadsheets for monthly or termly reports. | Automated generation of custom, on-demand reports with data visualisations and predictive insights. |

Key AI In Finance Trends for Education Finance in 2025 and Beyond

The field of AI in finance is evolving at a breathtaking pace. For forward-thinking finance leaders, it is crucial to be aware of the trends that will shape the next few years.

- Hyper-Personalisation: AI will move beyond generic reminders to enable hyper-personalised financial engagement. This could mean offering customised payment plans to families based on their payment history or sending proactive support messages to accounts flagged by the AI as being at high risk of default.

- Generative AI for Conversational Insights: The next evolution in AI in education finance is the use of Generative AI. Instead of just viewing dashboards, a bursar will be able to ask complex questions in plain English, such as, “What was the primary driver of our budget overspend in the first term, and what are the three most effective ways to mitigate it next year?” and receive a clear, narrative answer supported by data.

- Ethical AI and Governance: As AI becomes more integrated into financial decisions, the focus on governance and ethics will intensify. Institutions will need to ensure their AI systems are transparent, fair, and free from bias. Choosing technology partners who prioritise ethical AI development will be paramount, a topic of significant global discussion at forums like the World Economic Forum.

Conclusion: From Digital Administrator to Intelligent Strategist

AI in finance is no longer the stuff of science fiction. In 2025, it will be a practical, accessible, and essential tool for building a resilient and efficient financial function within the South African education sector. By automating routine tasks, providing predictive insights, and strengthening security, AI empowers bursars and their teams to transcend the daily grind of administration and embrace their role as core strategic partners in their institution’s success.

The journey, however, must begin with the right foundation: clean, structured, and centralised data born from a comprehensive digital payments ecosystem. Once this is in place, the potential for AI to optimise everything from cash flow to compliance is immense.For the modern bursar and finance team, the question is no longer if they should adopt AI, but how quickly they can build the foundation to do so. Embracing this technology is not just about adopting a new tool; it is about future-proofing your institution’s financial health and, ultimately, dedicating more time and resources to what truly matters—providing outstanding education.