For local merchants, finding the best payment gateway South Africa supports is a foundational strategic decision for any online enterprise. The best online payment methods not only streamline the customer payment experience but also integrate with core business systems, optimize transaction costs, and provide a scalable foundation for growth. A suboptimal choice can lead to lost revenue from checkout abandonment and excessive transaction fees.

This article provides a clear analysis of the top 5 online payment methods in South Africa. We evaluate them based on fee structures, operational usability, and integration capabilities. Since choosing the right digital payment infrastructure is a critical component of building a successful online business, you can explore the full landscape in our resource, Payment Gateway South Africa: The Ultimate Guide for Businesses.

A Comparative Overview of South Africa’s Top 5 Online Payment Methods.

South Africa’s e-commerce sector is supported by a mature ecosystem of highly capable, local providers. Based on market share and industry recognition, five online payment methods emerge as market leaders: PayFast, Peach Payments, Yoco Online, Ozow, and PayGate. The following table summarizes the primary use case and core strength of each provider.

| Gateway | Best For | Key Strength |

|---|---|---|

| PayFast | New & small businesses (SMEs) | Comprehensive features, zero monthly fees, rapid deployment. |

| Peach Payments | Scaling & enterprise businesses | Enterprise-grade features & robust API. |

| Yoco Online | Mobile-first & micro-businesses | Streamlined user experience and integrated POS ecosystem. |

| Ozow | High-value transactions | Cost-effective Instant EFT with chargeback elimination. |

| PayGate | Subscription-based businesses | High-reliability and advanced subscription management. |

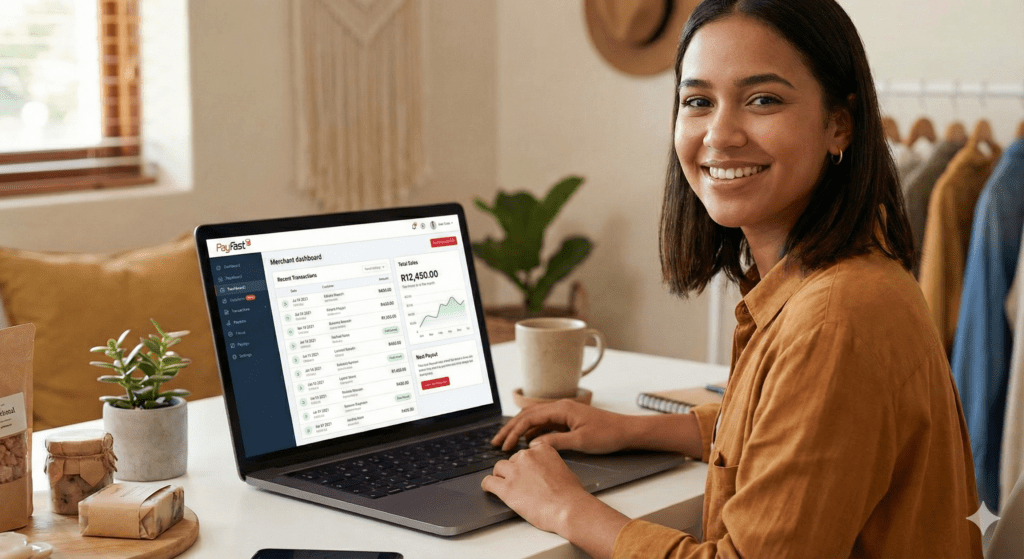

1. PayFast

PayFast is a prominent all-in-one payment gateway for South African SMEs. It is engineered for rapid deployment with a comprehensive suite of payment options.

Fees

Structure: No setup or monthly fees for a standard account. Fees are incurred on a per-transaction basis.

Standard Transaction Rates:

- Cards: Approximately 3.2% + R2.00 (ex. VAT).

- Instant EFT: Approximately 2% with a minimum of R2.00.

- QR/Wallets (e.g., SnapScan, Zapper): Approximately 3.2% – 3.5% + R2.00.

Best For: Micro to medium-sized transactions (R50 – R2,000). The fixed fee component is a key consideration for merchants processing micro-transactions.

Ease of Use

The sign-up process is entirely digital and is noted for its streamlined nature. For customers, the checkout experience is intuitive and secure, offering multiple payment methods (cards, EFT, wallets) on a single, hosted payment page.

Integration Support

PayFast offers robust integration support for popular e-commerce platforms. It provides well-documented plugins for:

- WooCommerce

- Shopify

- Magento

- PrestaShop

- Ecwid

It is highly regarded for its seamless WooCommerce integration, making it a preferred solution for WordPress-based e-commerce.

2. Peach Payments

Peach Payments is positioned as a solution for scaling businesses and enterprise-level organizations. It delivers advanced functionality, robust security protocols, and enterprise-grade support.

Fees

Structure: Pricing is typically customised, often involving a monthly fee in exchange for lower transaction rates, particularly at high volume.

Typical Transaction Rate: Card payments are frequently quoted around 2.95% + R1.50 per transaction.

Best For: Businesses with higher average order values (over R300) and sufficient transaction volume to leverage its tiered pricing model.

Ease of Use

While the onboarding process is more comprehensive than PayFast’s, reflecting its enterprise focus, its merchant dashboard and administrative tools are robust and feature-rich. Peach provides 365-day support, comprehensive reporting, and multi-site configuration. The customer checkout interface is modern and supports advanced functionalities such as recurring billing and multi-currency processing.

Integration Support

As noted by industry analysis from sources like SAShares, Peach Payments provides a robust, developer-centric experience with comprehensive API documentation. It has official plugins for all major platforms, including:

- Shopify

- WooCommerce

- Magento

- Wix

Its core strength is its capacity to support complex integrations requiring tokenization for subscription models or multi-currency processing for international commerce.

3. Yoco Online

As an established leader in the physical point-of-sale (POS) market, Yoco has expanded its offering to include streamlined and effective online payment solutions.

Fees

Structure: No monthly fees for Yoco Online. It utilizes a tiered pricing model where transaction rates decrease as monthly sales volume increases.

Typical Transaction Rate: Starts at approximately 3.05% (ex. VAT) for low-volume merchants and can decrease to 2.65% for high-volume sellers.

Best For: Existing Yoco customers, service providers, and businesses requiring simple payment link generation or a basic e-commerce checkout.

Ease of Use

Yoco’s primary value proposition is its streamlined user experience. The setup for online payments is highly efficient, especially for existing Yoco merchants. Merchants can generate and distribute payment links via email or messaging applications with minimal effort.

Integration Support

Yoco offers straightforward plugins for WooCommerce and Wix, designed for ease of implementation by non-technical users. While its integration ecosystem is more focused than that of PayFast or Peach Payments, it effectively serves its target market of small and mobile-first businesses.

4. Ozow

Ozow is a specialised provider focusing on the high-performance Instant EFT payment method. It facilitates secure, direct bank-to-bank transactions without requiring card details.

Fees

Structure: Ozow is one of the online payment methods recognised for its highly competitive pricing structure on EFTs.

Typical Transaction Rate: As low as 1.5% per transaction, with some plans including a minimum fee such as R1.00. This model offers significant cost savings compared to card processing for high-value transactions.

Best For: Businesses selling high-ticket items (e.g., electronics, travel, furniture) where card processing fees are substantial and chargeback fraud poses a significant risk.

Ease of Use

For customers, the workflow involves selecting Ozow at checkout, authenticating with their online banking credentials via Ozow’s secure portal, and authorising the payment. For merchants, the primary benefits are real-time payment confirmation and the complete elimination of chargeback risk—a significant advantage over traditional card payments.

Integration Support

Ozow is widely available as a payment option through other online payment methods like PayFast and Peach Payments. It also offers its own plugins for major e-commerce platforms and APIs for custom integration, enabling its seamless addition as a primary or supplementary payment method. As highlighted in a Netcash analysis of online payment methods, Instant EFT is a dominant force in the local market.

5. PayGate

PayGate is one of South Africa’s most established payment gateways, delivering exceptional stability, reliability, and specialised functionality for recurring billing and subscription management.

Fees

Structure: Typically employs a traditional pricing model which can include a setup fee and a monthly fee in addition to transaction fees.

Typical Transaction Rate: Rates are customised based on volume and business model.

Best For: Subscription-based businesses (SaaS, memberships), educational institutions, and established enterprises that require high reliability and support for complex billing models.

Ease of Use

The onboarding process with PayGate is a structured, consultative engagement. Its platform is engineered to provide a stable, bank-grade processing environment rather than a self-service startup experience. Its core strength is its robust backend functionality, particularly for managing complex recurring payment schedules.

Integration Support

PayGate is a trusted provider with mature, long-standing integrations for major platforms like WooCommerce and Magento. It also provides mature APIs that have been proven in complex, custom-built systems, making it a dependable choice for organizations with specific technical requirements.

Selecting the Best Payment Gateway South Africa for Your Business Model

- For new SMEs launching on platforms like WooCommerce: PayFast presents an optimal solution. Its combination of zero monthly fees, rapid deployment, and comprehensive payment method support is highly advantageous for new businesses.

- For scaling businesses with international objectives: Peach Payments provides the necessary multi-currency support, volume-based pricing, and developer-centric tools required for global expansion.

- For service-based or mobile-first businesses: Yoco Online delivers the most streamlined method for accepting payments via payment links, creating a unified ecosystem for merchants already using its POS terminals.

- For businesses with high average transaction values: Integrating Ozow is a strategic imperative. The potential cost savings and complete elimination of chargeback risk on high-value sales offer a compelling value proposition.

- For subscription-based enterprises: PayGate or Peach Payments offer the specialised tokenization and recurring billing architecture that is essential to managing a subscription-based revenue model.

By aligning your specific business requirements with the core competencies of each gateway, you can select a solution that not only processes payments but also optimizes your entire digital commerce operation for sustained success.