The Core Types of Card Machine

The card machine landscape has evolved significantly, offering a range of specialised solutions engineered to meet diverse operational requirements and environments.

Mobile Payment Terminals

These are compact, portable devices designed for organizations with mobile operations or those requiring payment flexibility outside of a fixed location. They typically integrate with a smartphone or tablet via Bluetooth, effectively converting the mobile device into a secure point-of-sale (POS) system. Mobile terminals are ideal for on-site service providers, event-based sales, and delivery services. If you are trying to decide between these portable units and a stationary setup, our Mobile Card Machine vs. Fixed: The Ultimate Guide for Your Business offers a detailed comparison to help you choose.

Countertop Terminals

Countertop terminals are foundational hardware for traditional retail and service environments. These are stationary, dedicated devices located at a checkout or service point, often integrated with a larger POS system via USB, Ethernet, or Wi-Fi. They are engineered for reliability and high-volume transaction processing, providing robust support for chip, contactless, and magstripe payment methods. A countertop card machine is often the preferred choice for high-volume retailers that need a dependable payment system similar to a fixed speed point machine.

Integrated POS Systems with Built-In Card Machine Functionality

For comprehensive operational management, all-in-one POS systems consolidate register functions, order management, and a built-in payment reader into a single, unified platform. These systems are optimal for established retail and hospitality businesses that require advanced capabilities for inventory management, sales analytics, and detailed reporting, streamlining processes from customer engagement through to backend administration.

Software-Based Terminals (Tap-to-Pay on Mobile)

Advancing beyond dedicated hardware, software-based solutions transform a standard smartphone into a payment acceptance device without requiring any external hardware. Leveraging integrated Near Field Communication (NFC) technology, solutions like Tap to Pay on iPhone or Android enable businesses to accept contactless card payments and mobile wallets (e.g., Apple Pay, Google Pay) directly on their existing mobile devices. This innovation delivers exceptional flexibility and operational cost-effectiveness.

How a Card Machine Transaction Works: A Step-by-Step Analysis

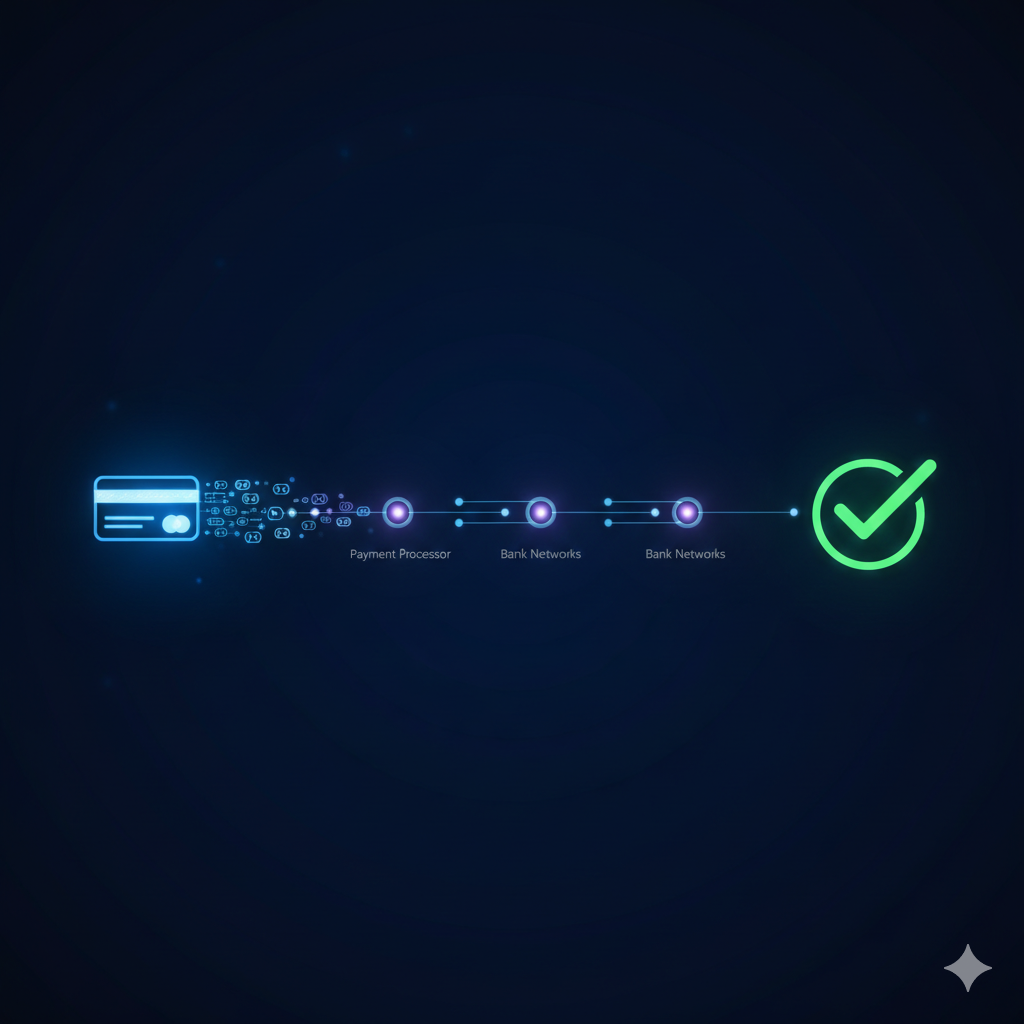

The payment transaction lifecycle, from the moment a card is presented to the settlement of funds, is a highly efficient and secure process. It is executed through a series of defined steps:

- Customer Initiates Payment: The transaction begins when the customer presents their card or mobile device to the terminal. This interaction occurs via:

- Magnetic Stripe: Swiping the card.

- EMV Chip: Inserting the card into the terminal.

- NFC: Tapping a contactless card or mobile device.

- Mobile Wallet: Utilizing a service like Apple Pay or Google Pay via NFC.

- Data Capture and Encryption: The payment terminal reads the card data, such as the Primary Account Number (PAN) and expiry date. This information is immediately encrypted to secure it against interception and fraud. For EMV chip transactions, the terminal and the chip collaborate to generate a unique, single-use transaction code (cryptogram), which provides a superior layer of security.

- Secure Transmission to the Payment Processor: The encrypted transaction data is transmitted securely over an internet connection (Wi-Fi, cellular, or Ethernet) to a payment processor. The processor functions as the secure intermediary between the merchant, the relevant card networks, and the involved financial institutions.

- Authorization Request: The processor routes the authorization request to the appropriate card network (e.g., Visa, Mastercard). The network then forwards the request to the customer’s issuing bank, which validates the transaction based on available funds, fraud detection protocols, and account status before approving or declining it.

- Authorization and Settlement: Upon approval, an authorization code is transmitted back through the network to the payment terminal, confirming the transaction. The approved amount is reserved on the customer’s account, and the funds are scheduled for settlement into the merchant’s account, a process that typically completes within 1-2 business days.

Swipe vs. Chip vs. Tap: A Security and Technology Comparison

The payment method employed directly impacts both the efficiency and the security of a transaction.

Swipe (Magnetic Stripe)

The magnetic stripe on a payment card stores static, unencrypted account data. Swiping the card through a reader transmits this fixed data. While still supported for backward compatibility, this method is the least secure, as the data can be easily captured and replicated (skimmed). As a result, magstripe-only transactions are being systematically phased out globally in favor of more secure technologies.

Chip (EMV)

EMV (Europay, MasterCard, and Visa) cards contain an embedded microprocessor chip that generates dynamic, encrypted data for every transaction when inserted into a terminal. Unlike the static data on a magnetic stripe, this cryptographic authentication makes it exceedingly difficult to counterfeit cards or transaction data. Adopting EMV-compliant terminals is a critical business practice that reduces liability for fraudulent transactions.

Tap / Contactless (NFC)

Contactless payments utilize Near Field Communication (NFC) technology, allowing for a transaction to be completed by holding a card or mobile device within a few inches of a compatible reader. This method facilitates rapid, convenient, and hygienic payments. While individual transactions may be subject to a CVM (Cardholder Verification Method) limit (e.g., R500 in South Africa before a PIN is required), its adoption is widespread across retail, transit, and corporate environments.

Standard Capabilities of Modern Terminals

Contemporary payment terminals are engineered for versatility, supporting multiple payment methods to maximize security and customer convenience. Standard support in modern terminals includes:

- Chip (EMV): The global standard for secure in-person transactions, essential for mitigating fraud liability.

- Tap (NFC): Enables seamless contactless payments from both physical cards and mobile wallets like Apple Pay and Google Pay.

- Swipe (Magstripe): Maintained primarily for compatibility with older cards but is not the preferred or most secure method.

- Mobile Wallets: Processed via NFC, these methods use tokenization to transmit a secure, one-time representation of the card number, adding a powerful layer of data protection.

When selecting a payment terminal, South African organizations must evaluate factors such as transaction volume, mobility requirements, and integration capabilities. To ensure you find a solution that fits your budget, we recommend reviewing our Card Machine Price South Africa: The Ultimate 2026 Guide for a clear breakdown of costs.

Embracing the Future of Payment Solutions

A card machine is not merely a transaction-processing tool; it is an integral component of a modern organization’s operational infrastructure. It enhances the customer experience, improves efficiency, and secures revenue streams. By understanding the different terminal types and the technologies that power them, organizations can make strategic decisions to protect their transactions, maintain a competitive edge, and meet the evolving demands of the market. The right payment technology empowers an organization to streamline operations and thrive within the expanding cashless ecosystem.

If you’d like a tailored recommendation — based on your business model, transaction volume, and payment needs — we can help.

👉 Book a demo with Eezipay today to discover the ideal payment terminal setup for your organization.