Choosing a payment terminal for your organization in South Africa requires a strategic decision: should you purchase the hardware outright (a key factor for many businesses comparing card machine price) or engage in a rental agreement with a provider? The optimal choice is contingent upon your business’s transaction volume, cash flow requirements, and operational strategy. A once-off purchase may present a lower initial outlay, but monthly rental models can provide more competitive transaction rates and inclusive support services.

This guide provides a detailed analysis of the costs associated with both acquisition models, empowering you to calculate the most cost-effective solution for your specific operational context. We will compare the pricing structures of innovative providers like Yoco and iKhokha against conventional bank rentals to offer a comprehensive market overview.

The Two Primary Acquisition Models: Purchase vs. Rental

Understanding the fundamental distinctions between these two options is the first step toward making an informed, strategic decision.

The Purchase Model

This model involves acquiring the hardware through a single, once-off payment, granting you full ownership of the device.

- Upfront Investment: A one-time payment ranging from R499 to over R3,000, determined by the device’s capabilities (e.g., a simple Bluetooth-enabled reader versus a standalone smart POS terminal with an integrated printer).

- Monthly Fees: Typically, there are no fixed monthly fees. Costs are incurred based on processed transaction volume.

- Transaction Rates: Rates are generally a flat percentage, commonly between 2.5% and 2.95% per transaction. Some providers may apply a nominal secondary fee per transaction or per trading day.

This model, offered by fintech innovators like Yoco, iKhokha, and Capitec, provides a streamlined, contract-free solution that appeals to small and emerging enterprises.

The Rental Model

This is the conventional model provided by major financial institutions (where the speed point machine price is usually built into monthly rental fees) and some specialized POS providers.

- Upfront Investment: Minimal to zero, with a possible setup fee.

- Monthly Fees: A recurring fixed rental fee is required, typically ranging from R299 to over R500. This cost often includes device maintenance and dedicated support. Certain providers may also enforce a minimum monthly service fee.

- Transaction Rates: Rental agreements frequently feature lower, negotiable transaction rates, particularly for organizations with high transaction volumes. These rates can be structured with distinct percentages for debit and credit card transactions.

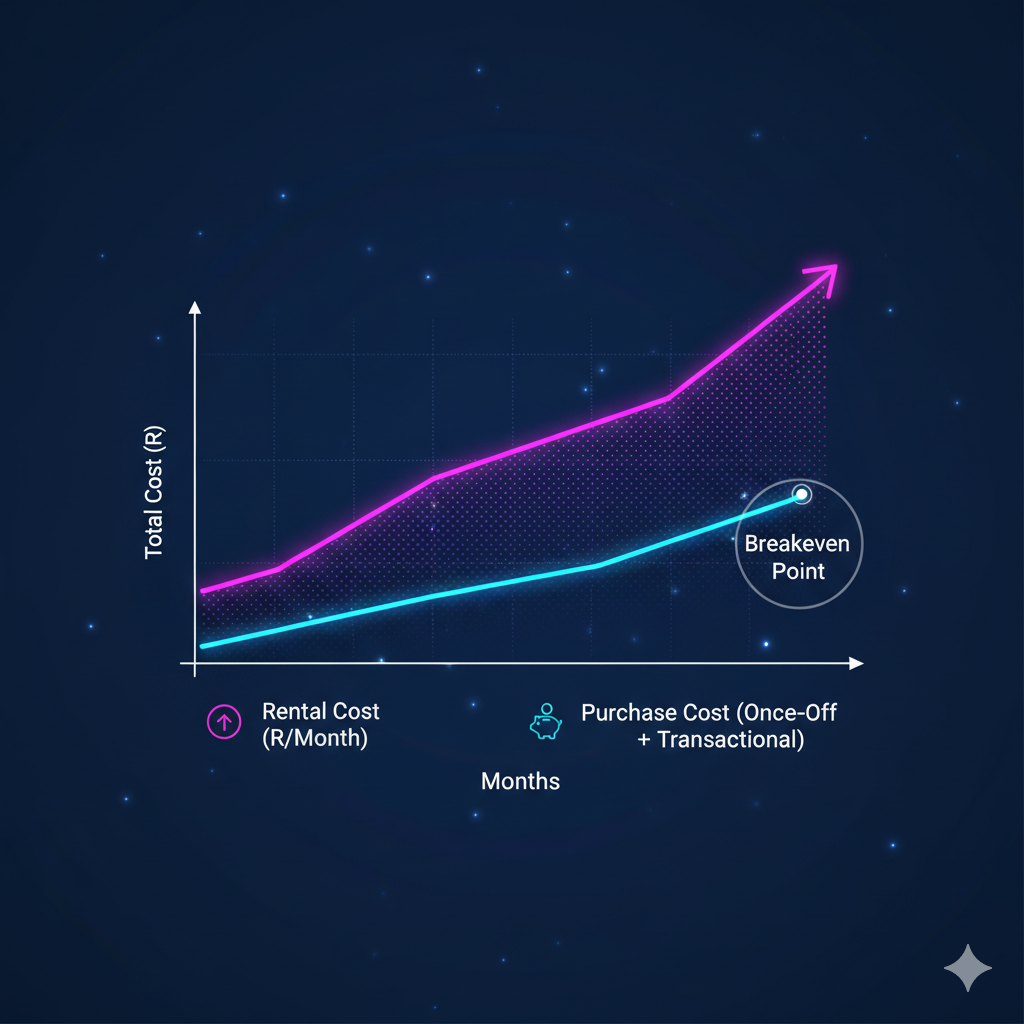

Comparative Cost Analysis: Purchase vs. Rental Models

Let’s examine the financial implications and how card machine price affects overall affordability.The most cost-effective long-term option is almost entirely dependent on your monthly sales volume.

Scenario 1: Low-Volume Transaction Environments (e.g., R10,000 per month)

For a small or new enterprise, a purchase model is almost invariably the more cost-effective solution.

- Purchase Example (e.g., iKhokha Mover Pro):

- Once-off Cost: ~R499

- Monthly Fee: R0

- Transaction Fees (at ~2.5%): R10,000 x 2.5% = R250 per month

- Total Annual Cost (inclusive of hardware): R499 + (R250 x 12) = R3,499

- Rental Example (e.g., Standard Bank Portable Terminal):

- Once-off Cost: R0

- Monthly Fee (incl. VAT): ~R437

- Transaction Fees (assuming a lower 1.8% rate): R10,000 x 1.8% = R180 per month

- Total Annual Cost: (R437 + R180) x 12 = R7,404

Analysis: For low-volume businesses, purchasing a device yields significant cost savings. The substantial monthly rental fee associated with a bank terminal negates the benefit of a marginally lower transaction rate.

Scenario 2: Medium to High-Volume Environments (e.g., R80,000 per month)

As sales volume increases, the financial dynamics change. The lower transaction rates of a rental model can begin to yield significant savings.

- Purchase Example (e.g., Capitec Pro):

- Once-off Cost: R699

- Monthly Fee: R0

- Transaction Fees (tiered rate, avg. ~1.3% for this volume): R80,000 x 1.3% = R1,040 per month

- Total Annual Cost (inclusive of hardware): R699 + (R1,040 x 12) = R13,179

- Rental Example (e.g., Standard Bank Portable Terminal):

- Once-off Cost: R0

- Monthly Fee: ~R437

- Transaction Fees (negotiated down to 1.1%): R80,000 x 1.1% = R880 per month

- Total Annual Cost: (R437 + R880) x 12 = R15,804

Analysis: In this scenario, a purchase model from a provider with competitive tiered rates, such as Capitec, can remain the more financially advantageous option. However, if a financial institution offers a highly aggressive transaction rate, the rental model becomes increasingly competitive.

Strategic Factors Beyond Cost

The total cost of ownership extends beyond transactional and rental fees. You must also evaluate these critical factors.

Hardware Capabilities & Integrated Features

Evaluate whether a basic payment acceptance device is sufficient, or if your operations require a more advanced, integrated POS platform. Standalone smart POS devices deliver enhanced functionalities like inventory management, real-time data analytics, and built-in printers. To dive deeper into the different types of card machines and their capabilities, explore our detailed resource, Card Machine Explained: An Essential Guide for Your Business.

Contractual Obligations & Operational Flexibility

Purchase models from providers like Yoco and iKhokha are typically contract-free. This flexibility is a significant benefit for businesses with fluctuating revenue streams or those unable to forecast future turnover. Bank rentals typically require long-term contracts (e.g., 24-36 months) that include penalties for early termination.

Support & Maintenance

Rental agreements usually bundle support and hardware replacement services into the monthly fee, ensuring business continuity. If a terminal malfunctions, the provider will facilitate a rapid replacement, often with on-site support. With a purchased device, you assume responsibility for the hardware outside of its warranty period. A device failure may necessitate a new purchase.

Settlement Speed & Cash Flow Management

Evaluate the provider’s settlement timeline. Most modern providers deliver settlement within 1-2 business days. It is critical to confirm that the provider’s settlement schedule aligns with your organization’s cash flow requirements.

Conclusion: Selecting the Optimal Model for Your Business

A Purchase Model is Recommended For:

- Small businesses, startups, or sole traders with a monthly turnover below R50,000.

- Organizations with inconsistent or seasonal sales, where a fixed monthly fee presents a financial risk.

- Businesses that prioritize operational flexibility and wish to avoid long-term contractual commitments.

- Users who are comfortable with remote technical support and self-managing their hardware assets.

A Rental Model is Recommended For:

- Established, high-volume businesses with consistent monthly turnover (typically exceeding R100,000).

- Operations where card payment uptime is mission-critical, requiring the assurance of on-site support and rapid hardware replacement.

- Organizations with sufficient sales volume to negotiate substantially lower transaction rates that offset the monthly rental cost.

- Businesses requiring the advanced, integrated POS functionalities often bundled with comprehensive rental packages.

By conducting a thorough evaluation of your monthly transaction volume and balancing the need for flexibility against the value of comprehensive support, you can confidently select the payment terminal acquisition model that best supports your organization’s growth and profitability.

Ready to make the most cost-effective choice for your business payments?

Partner with Eezipay for seamless, secure solutions that scale as you grow. Whether you’re buying or renting payment terminals, our expert team can tailor the right setup for your organisation.

👉 Get in touch with Eezipay today to discuss your payment needs and see how we can help you save on costs and streamline operations.