Employee wellness has become a strategic priority for South African organisations. Rising living costs, financial pressure, and workplace stress are increasing the need for accessible, meaningful support that genuinely improves staff wellbeing and engagement.

Yet many companies struggle to deliver an effective wellness strategy. Benefits are fragmented across multiple vendors, participation is low, and HR teams carry the heavy burden of manual administration.

This raises a key question: How can organisations offer a wellness experience that’s engaging, easy to access, and simple to manage — without adding more admin for HR and Operations teams?

More businesses are discovering that the answer lies in a tool employees already use every day: a digital wallet.

A digital wallet, also known as a staff wallet, does more than replace cash. It creates a central, secure platform for distributing allowances, rewards, wellness perks, and company-supported benefits — all in a way that’s convenient for employees and efficient for administrators.

In this article, we explore how digital wallets are reshaping employee wellness and engagement in South Africa, and why HR leaders are increasingly incorporating them into their modern wellness programmes.

Table of Contents

What Is a Digital Wallet?

A digital wallet or a staff wallet is a secure, app-based account where organisations can allocate funds, perks, and incentives directly to employees. With platforms like Eezipay’s Cashless Workplace solution, employees can use their digital wallet (or NFC staff card) at approved points, such as:

- Smart canteens or workplace cafeterias

- On-site tuckshops or staff stores

- Partnered with wellness or service providers

- QR-enabled terminals and mobile POS devices

Behind the scenes, HR and Operations teams manage everything through a unified portalinclusing allowances and rewards to real-time reporting.

To learn more about how the technology works, see: The Ultimate Guide to Staff Wallet Systems: Definition, Benefits, and ROI

Why Are Digital Wallets Becoming Essential for Employee Wellness Programmes?

Traditional wellness programmes often fall short because they rely on fragmented systems and a “one-size-fits-all” approach. A digital wallet solves these challenges by offering a personalised, cashless, and friction-free experience for both employees and administrators.

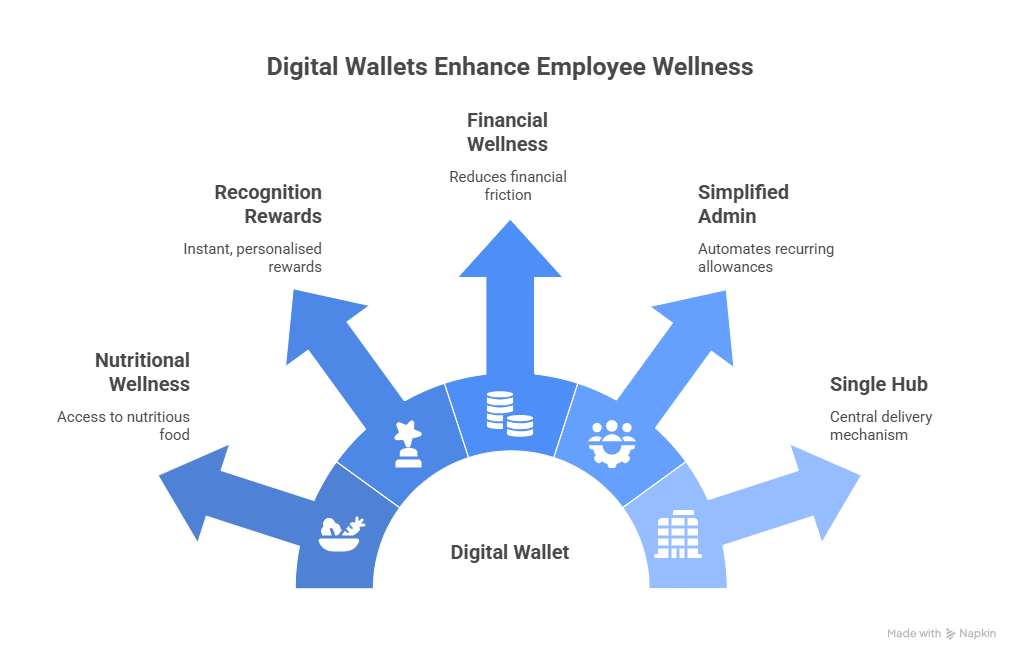

Below, we explore how a digital wellness wallet directly strengthens key pillars of employee wellbeing in South Africa.

1. Promoting Nutritional Wellness

Access to nutritious food is foundational to employee wellness, especially in sectors where long hours, shift work, and rising food costs can impact productivity. With a digital wallet, organisations can support nutritional wellness in practical, meaningful ways.

With a digital wallet, HR teams can:

- Load meal allowances daily, weekly, or monthly

- Subsidise healthy options, automatically discounting approved items

- Create targeted promotions, like “Fruit Fridays” or healthy meal campaigns

- Track dietary trends, helping caterers optimise menus based on real data

This approach is beneficial for organisations with on-site canteens, catering services, or staff shops. For a deeper look at how digital wallets enhance workplace food programmes from cashless payments to healthier meal incentives — read our guide on: Corporate Canteen Digital Wallets: A Powerful Way to Transform Operations

2. Strengthening Recognition and Rewards

Recognition is one of the strongest drivers of morale and engagement. Digital wallets make this easier and far more impactful by enabling instant, personalised rewards.

Organisations can reward employees instantly:

- Send spot rewards (e.g., “Thank you for your hard work this week — here’s R150!”)

- Celebrate birthdays, work anniversaries, and milestones automatically

- Run team competitions with wallet credits as prizes

- Allocate departmental budgets to managers for team-building

This immediacy gives rewards greater emotional impact. Instead of waiting for payroll adjustments or relying on paper vouchers, employees receive benefits directly in their digital wallet, ready to use at approved points across the workplace.

3. Supporting Financial Wellness

Financial pressure is one of the biggest contributors to stress among South African employees, with recent research showing high levels of financial stress across the workforce. Although a digital wallet is not a bank account, it plays a meaningful role in reducing everyday financial friction.

Through a single interface, employees can see:

- Meal allowances

- Wellness stipends

- Transport support

- Reward credits

- Once-off incentives

This visibility helps staff manage company-provided funds more confidently and reduces the need for out-of-pocket expenses.

For HR and Operations teams, it also creates transparent, auditable records, which support compliance and simplify payroll processes.

4. Simplifying Administration for HR & Operations

One of the biggest advantages of adopting a digital wallet is the significant reduction in administrative work. Traditional benefit systems require manual distribution, cash handling, and reconciliation — all of which are time-consuming and prone to error.

With a digital staff wallet system, HR teams can:

- Automate recurring allowances (canteen, transport, wellness)

- Make bulk or once-off payments instantly

- Allocate controlled budgets to departments

- Access real-time reporting for participation and spend

- Reduce reconciliation and petty cash administration

- Improve fraud prevention with controlled, auditable usage

This frees HR professionals to focus on strategic initiatives instead of getting bogged down in manual tasks.

5. A Single Hub for All Employee Benefits

A digital staff wellness wallet is not limited to food or rewards. It can become the central delivery mechanism for all workplace benefits, including:

✔ Wellness stipends: for mental health apps, fitness gear, and counselling contributions.

✔ Transport and commuting support: enable controlled allocations for daily travel expenses, which is vital for many SA employees.

✔ Remote work allowances: simplify reimbursement for data, home office supplies, or equipment.

✔ Team social or culture budgets: give managers controlled, auditable funds for morale-building activities.

✔ Learning & development incentives: allocate credits that employees can use for upskilling.

Centralising these elements improves the employee experience and allows organisations to track, measure, and optimise their wellness initiatives over time.

If you want a deeper understanding of the full system behind a wallet-based solution, read our pillar guide: The Ultimate Guide to Staff Wallet Systems: Definition, Benefits, and ROI

Traditional Wellness vs Wallet-Based Wellness

Here’s how traditional wellness programmes compare to a modern digital wallet approach:

| Feature | Traditional Wellness Programme | Digital Wallet-Based Wellness |

|---|---|---|

| Administration | Manual, high admin (spreadsheets, vendors). | Automated, low admin |

| Employee Experience | Fragmented, often unused | Seamless, centralised, high engagement |

| Recognition & Rewards | Delayed, generic | Instant, personalised, tangible |

| Data & Insights | Minimal | Real-time, comprehensive |

| Personalisation | One-size-fits-all | Highly tailored |

| Security | Paper-based, prone to misuse | Cashless, secure, auditable |

| Compliance | Difficult to track | Streamlined with clear records |

The ‘Eezi Way’: A Seamless Experience for HR and Staff

Eezipay’s digital wallet solution is part of its broader Cashless Workplace platform, built specifically for South African organisations across various sectors, including hospitality, agriculture, manufacturing, corporate services, and education.

The platform includes:

- NFC-enabled staff cards

- QR and tap-to-pay functionality

- Smart canteen and mobile POS devices (MPT terminals)

- Real-time cloud reporting

- Automated funding tools

- Payroll integration

- Controlled spending rules

- Local onboarding and support

This makes it easy to launch a scalable, low-admin wellness and engagement strategy that delivers real value to employees.

A Simpler, Smarter Path to Employee Wellness

Rethinking your corporate wellness strategy doesn’t have to mean adding more vendors or more complexity.

By consolidating your benefits, rewards, and canteen funds into a single digital staff wallet, you create a powerful, flexible, and highly engaging ecosystem. You give employees the choice and convenience they expect, while gaining the administrative simplicity and data insights needed to build a truly effective employee wellness programme.

It’s the ‘Eezi’ Way to show your team you care, boost engagement, and build a healthier, happier workplace.

Ready to Elevate Employee Wellness?

Creating a supportive and engaging employee experience doesn’t require more systems, more admin, or more manual work. A digital wallet brings everything together — from nutrition to recognition — in one seamless platform your team will actually use.

➡️ Explore our Workplace Canteen Solutions to see how digital wallets enhance nutrition, recognition, and daily engagement.

➡️ Or book a personalised demo to see how Eezipay can help you build a modern, cashless wellness strategy tailored to your organisation.

![How QR Code Payments Are Powering a Brighter Future for Universities [2025]](https://eezipay.com/wp-content/smush-webp/2025/05/QR-Codes-Payments-For-Universities-400x250.png.webp)