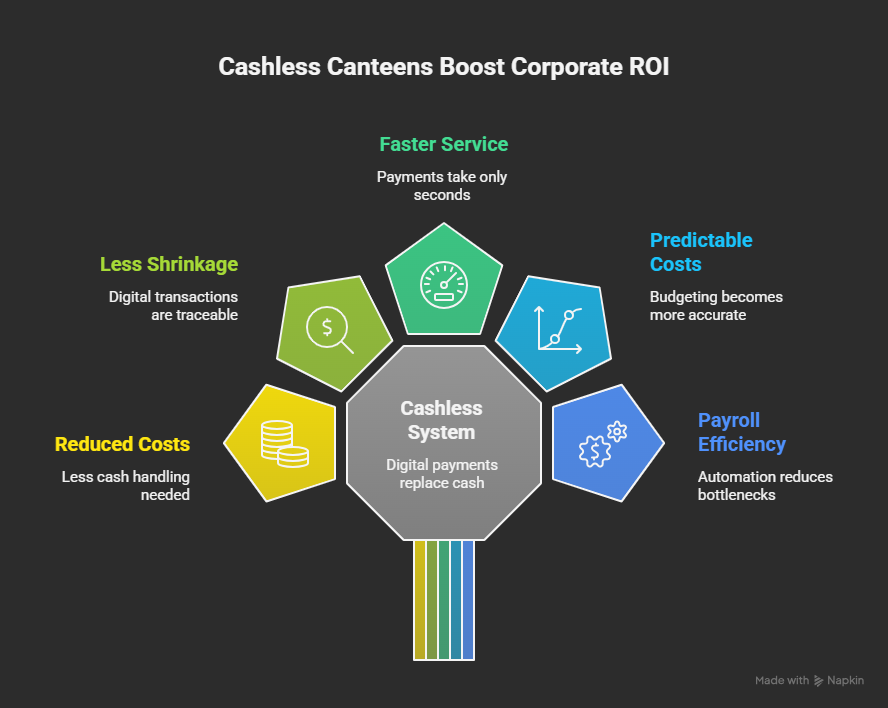

Going cashless has become one of the most efficient ways for organisations to reduce operational costs, strengthen financial controls, and modernise the management of workplace meals. For CFOs, finance leaders, and operations executives, the shift is far more than a payment upgrade — it reshapes how money flows through your canteen, how benefits are administered, and how accurately meal-related costs are recorded and reconciled.

In this blog, we break down the financial and operational ROI of transitioning to a cashless corporate canteen. You’ll learn how digital wallet ecosystems reduce shrinkage, streamline payroll alignment, enhance forecasting, support SARS fringe-benefit compliance, and deliver significant time savings for finance and HR teams. We’ll also explore the employee experience improvements and performance gains that strengthen the ROI case.

Table of Contents

Why “Going Cashless” Delivers Immediate ROI

Going cashless removes one of the most inefficient components of corporate canteen operations: physical cash handling. While the costs of dealing with cash often appear small in isolation, they accumulate across multiple processes — reconciliation, shrinkage, labour time, errors, and security risks. When replaced with a controlled, closed-loop system, these inefficiencies disappear almost overnight.

Here’s how organisations realise ROI from day one:

1. Cash Handling Costs Are Eliminated

Cash-based canteens incur measurable overhead:

- Staff time spent preparing floats, allocating tills, counting money, and balancing end-of-day totals

- Risk of cash loss, theft, or skimming

- Transport or third-party cash-collection fees

- Labour hours spent resolving discrepancies and disputes

A cashless model converts these costs into immediate savings. Finance teams no longer waste hours on manual reconciliation, and operational staff no longer handle float administration.

2. Shrinkage Reduces Dramatically

Shrinkage often goes unreported because it is difficult to trace in cash environments. A digital wallet system ensures:

- Every transaction is digital and traceable

- No manual discounting or side payments

- Real-time audit logs

- Zero cash slips, handwritten totals, or manual overrides

The result: predictable revenue, better profitability, and fewer losses.

3. Faster Service = Higher Throughput

Cash slows queues. Slow queues reduce orders.

With NFC cards or QR-based wallets, payments take seconds, not minutes. This leads to:

- Higher-order volumes within the same time window

- Increased average spend per break period

- Lower queue frustration and fewer staff returning late

At EFRC, automated Sage-ready deduction exports materially improved payroll accuracy, eliminated erroneous or missed deductions, and reduced end-of-month rework cycles.

4. Predictable Costs and Cleaner Budgeting

Cashless systems allow employers to set:

- Monthly or daily limits

- Rules for eligible items

- Restricted spend categories

- Fringe-benefit allocations with SARS-ready reporting

This provides CFOs with predictable monthly cost control and stronger forecasting accuracy.

For detailed guidance on SARS-approved meal voucher structures, see our blog on Fringe Benefits and SARS Compliance.

5. Payroll and Tax Efficiencies

Where canteen spending or meal benefits are linked to payroll, automation provides measurable ROI:

- Month-end deduction reports are generated automatically

- SARS-compliant fringe-benefit values for meal vouchers

No manual slip matching or spreadsheet manipulation - Reduced payroll close-out bottlenecks

At EFRC, automated Sage-ready deduction exports materially improved payroll accuracy, eliminated erroneous or missed deductions, and reduced end-of-month rework cycles.

To see how automated deductions and SARS-ready reporting work in practice, explore our blog on Payroll Integration with Staff Wallets.

Operational ROI: Where the Hidden Savings Come From

Financial ROI is clear — but operational ROI is where organisations often achieve the biggest long-term performance gains. Going cashless transforms the canteen from a cost centre into a controlled, auditable, and efficient operational ecosystem.

1. Reduced Administrative Overheads

Admin teams no longer manage:

- Paper slips

- Manual staff account adjustments

- Card-charger handling

- Manual stock/transaction reconciliations

Digital wallets reduce monthly hours spent on repetitive admin, allowing teams to focus on strategy rather than processing.

2. Stronger Stock and Procurement Forecasting

Real-time data improves:

- Ingredient planning

- Waste management

- Preparation volumes

- Supplier ordering cycles

With accurate transaction logs, canteens avoid over-prepping, and procurement avoids over-ordering.

3. Streamlined HR & Compliance Management

From staff card issuing to suspended accounts, HR gains:

- Instant card block/replacement

- Tiered permissions

- Controlled spend categories for different staff classes

- Digital records that align with audit policies

This reduces HR workload and audit-related risk.

Real-World ROI: What Going Cashless Delivered at EFRC

While the ROI case for cashless corporate canteens is well established, real-world implementation provides the strongest validation.

At EFRC, a multi-site agricultural operation, going cashless delivered measurable results within the first months of implementation. Internal staff sales increased by approximately 30% following deployment, driven in large part by faster service, reduced queue times, and consistent access to digital meal benefits. HR and Finance teams saved an estimated 10–12 hours per month by eliminating paper slips and automating payroll deduction reporting.

Operating within a fully closed-loop environment, shrinkage was reduced to zero through auditable digital transactions. A standard R1,500 monthly spending limit per employee introduced predictable cost control and improved budget forecasting. Across four active sites, EFRC gained a unified operational view, strengthened audit readiness, and delivered a more consistent, frictionless staff experience.

To see these ROI gains in action, read how EFRC digitised meal management and removed manual reconciliation challenges in the EFRC: Digitising Staff Spending With a Closed-Loop Cashless Wallet System

How Cashless Canteens Improve Employee Experience

Employee experience directly influences productivity and indirectly affects financial output.

1. Fair, Consistent Access to Meals

Staff wallet systems ensure:

- Equal, standardised meal rules

- No stigma associated with cash

- No out-of-pocket costs

- Seamless tap-to-pay experience

2. Supports Financial Wellness

Closed-loop wallets encourage structured spending and protect employees from taking on debt for workplace meals.

3. Better Nutrition, Better Output

Consistent access to meals improves productivity, engagement, and overall focus, with measurable operational benefits in factory, hotel, and shift-based environments.

ROI Comparison Table — Cash vs Cashless

Before diving into the technology, here is a quick comparison highlighting where ROI emerges when shifting from cash-based to digital wallet–based environments.

| Cost/Outcome Area | Cash-Based Canteen | Cashless Canteen (Digital Wallet) | ROI Impact |

|---|---|---|---|

| Cash handling labour | High | Eliminated | Direct cost savings |

| Shrinkage & leakage | Moderate–High | Near zero | Loss prevention |

| Transaction speed | Slow | Instant | Higher throughput & revenue |

| Admin & payroll effort | High | Automated | Operational efficiency |

| Audit readiness | Weak | Strong, real-time | Compliance ROI |

| Staff experience | Inconsistent | Simple, frictionless | Productivity improvement |

| Forecasting accuracy | Low | High | Better budgeting & planning |

What Technology Powers a High-ROI Cashless Canteen?

Here we unpack why each component contributes to ROI — helping CFOs understand which elements drive efficiency, compliance, and cost reduction.

1. Closed-Loop Wallet Systems

A closed-loop system ensures spending occurs only at approved merchants (e.g., internal canteens). This delivers:

- Full control

- Zero unauthorised transactions

- Accurate reporting

- SARS-friendly benefit structuring

For a deeper understanding of how closed-loop ecosystems strengthen spend control and compliance, read our guide on the benefits of Closed-Loop Wallet Systems.

2. Digital Wallets and NFC Cards

Digital wallets ensure:

- Instant transactions

- Lower queue times

- Automated spend tracking

- Integration with payroll or benefit structures

For a comparison of leading platforms, explore the best wallet solutions for workplaces in our guide to the top digital wallets for staff canteens.

3. Mobile POS Terminals

Modern terminals support:

- Wallet payments

- QR scans

- Card acceptance where needed

- Real-time cloud reporting

These devices reduce infrastructure overhead and simplify rollout across multiple branches.

4. Payroll Integration & Reporting

Automated deduction files and monthly benefit reports provide:

- Faster payroll close-outs

- Consistent SARS compliance

- Zero manual intervention

For a real-world example of the ROI achieved by going cashless, explore how a large agricultural operation digitised its entire staff meal system, eliminated manual slip matching, and streamlined payroll reporting. Read the EFRC Staff Wallet System case study.

FAQs

1. What does it mean to go cashless in a corporate canteen?

Going cashless means replacing physical cash with a digital wallet or NFC card system. Staff tap or scan to pay, and all transactions are recorded digitally, improving speed, security, and reporting accuracy.

2. Is a cashless canteen more cost-effective?

Yes. Digital canteens reduce cash-handling labour, eliminate shrinkage, automate payroll reporting, and improve throughput — all of which directly improve the bottom line.

3. How do digital wallets work in a company canteen?

Each staff member receives a digital wallet linked to an NFC card or app. Funds may be preloaded, allocated as a fringe benefit, or deducted from payroll at month-end. Spending is restricted to the canteen, ensuring control and compliance.

4. Does a cashless canteen help with SARS compliance?

Yes — when using a regulated closed-loop wallet model. Fringe-benefit meal vouchers must be recorded, non-convertible to cash, and used only for approved meals. Eezipay provides payroll-ready reporting for SARS Code 3801 where applicable.

Conclusion: The Eezi Way to Unlock Measurable ROI

A cashless corporate canteen is more than a convenience upgrade — it is a measurable financial improvement across cost control, payroll accuracy, compliance, and workforce efficiency. From eliminating shrinkage to strengthening audit readiness, the ROI case is compelling for any organisation looking to modernise workplace operations.

Explore the Eezi Way to Go Cashless

If your organisation is evaluating the financial or operational impact of going cashless, Eezipay can help you model the ROI and design a cashless canteen solution that fits your workforce.

Ready to move forward? Speak to our solutions team and explore how Eezipay’s staff wallet and cashless canteen systems can deliver measurable returns