Analyzing the Cost Structure: Financial Implications

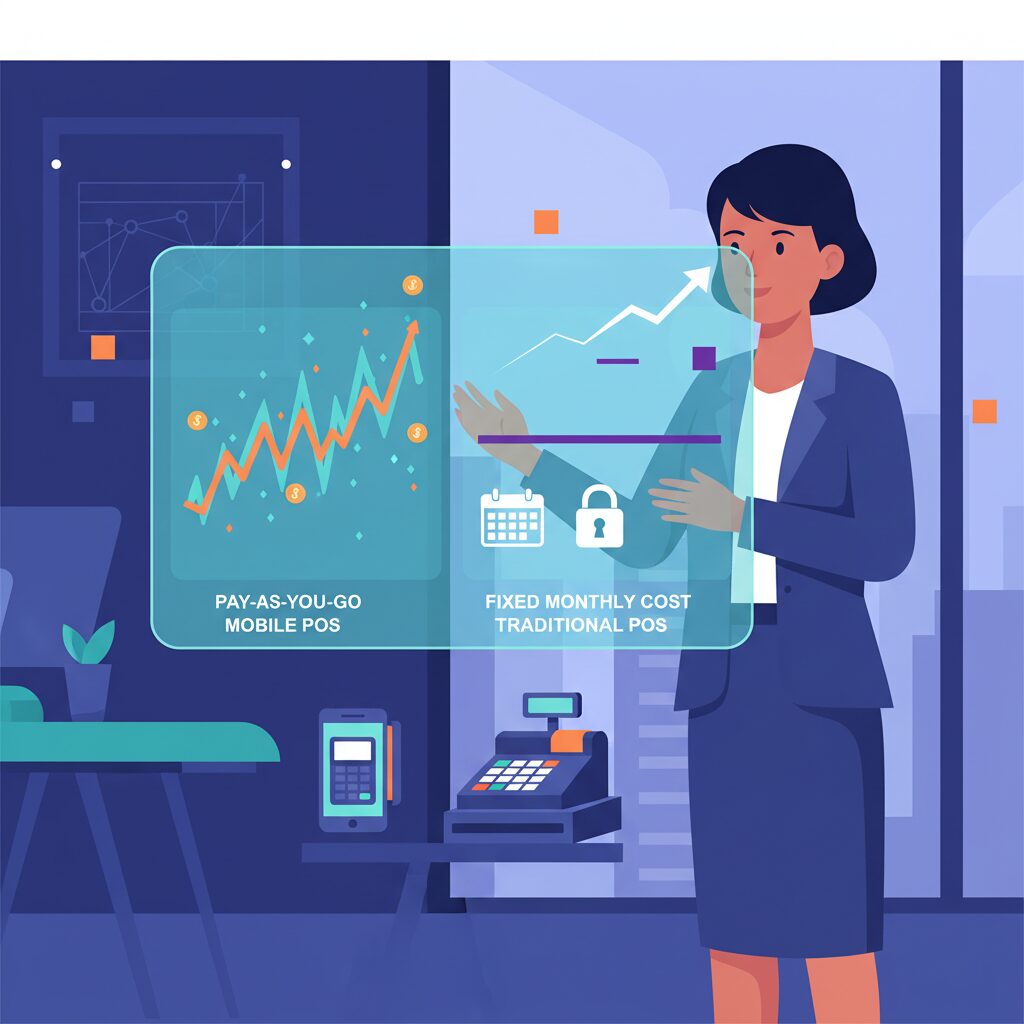

The most significant factor for any business is the financial impact. Mobile and traditional solutions are built on fundamentally different pricing models.

Mobile Card Machine (e.g., Yoco, iKhokha)

These devices are characterized by their accessible capital expenditure and a transparent fee model.

- Pros:

- Minimal Initial Investment: A one-time device purchase eliminates the need for lengthy contracts and significant upfront capital.

- No Fixed Monthly Costs: Most entry-level models have no fixed monthly rental fees. This model aligns costs directly with revenue generation, eliminating fixed expenses during periods of low activity, which is ideal for seasonal or project-based businesses.

- Transparent, Blended Rates: A single, blended percentage fee is applied to every transaction, which simplifies financial forecasting and expense management.

- Cons:

- Potentially Higher Costs at High Volume: The blended fee structure can become less cost-effective than a negotiated bank rate for enterprises with significant and consistent monthly card-based turnover (e.g., exceeding R100,000).

Traditional Bank POS Terminals

Supplied by major financial institutions like FNB, Absa, and Standard Bank, these terminals are engineered for established enterprises with high transaction volumes.

- Pros:

- Negotiable, Volume-Based Rates: For enterprises with substantial turnover, banks can offer highly competitive, negotiated merchant service fees (MSF), often below 1.5%.

- Integrated Banking Benefits: Financial institutions may offer reduced POS fees as part of a bundled package with other business banking products and services.

- Cons:

- Fixed Monthly Rental Fees: Businesses are committed to a fixed monthly rental fee for the device, irrespective of transaction volume.

- Long-Term Contractual Obligations: These agreements typically involve 24 or 36-month contracts with penalties for early termination.

- Ancillary Charges: Be aware of potential additional charges for installation, data connectivity (SIM), and PCI compliance.

Operational Mobility and Application Scenarios

Your business model and physical environment are crucial in determining the most suitable solution.

The Agility of Portable Card Machine

A portable card machine is ideal for organizations requiring transactional capabilities beyond a fixed physical location. Their reliance on battery power and mobile data connectivity (via a smartphone or integrated SIM) delivers exceptional versatility.

- Ideal For:

- Event-Based Commerce & Pop-Up Retail: Enables transaction processing at any location, from industry expos to temporary retail activations.

- Field Service Providers: Empowers professionals like plumbers, technicians, and delivery services to accept payment securely at the client’s premises.

- Emerging Businesses & Sole Proprietors: The rapid, digital-first onboarding process facilitates immediate operational readiness for new and informal enterprises.

The Stability of Traditional Terminals

Bank-issued terminals are the mainstays of established retail and hospitality sectors, engineered for high-volume, stable environments.

- Ideal For:

- Fixed-Location Retail Operations: Essential for supermarkets, pharmacies, and apparel stores requiring multiple, highly reliable payment points.

- Hospitality and Service Industries: These devices frequently feature integrated functionalities for gratuity management, bill splitting, and integration with table management systems.

- Multi-Location Enterprises: Banks provide centralized reporting platforms and dedicated support structures for businesses managing numerous branches.

Speed, Reliability, and Support

While the core tap-and-pay transaction speed is comparable, the surrounding processes like deployment and network stability differ significantly.

Deployment and Connectivity

- Deployment Speed: Mobile POS providers offer significantly faster deployment. Businesses can typically complete an online application and have a device delivered and active within 1-3 business days. Bank onboarding is a more comprehensive process requiring extensive documentation and takes approximately 3-10 business days.

- Reliability: A traditional terminal connected via a stable ethernet connection offers superior reliability and operational continuity compared to a mobile device dependent on cellular network signal strength. For fixed-location enterprises, bank terminals provide a more robust solution.

- Support: Mobile card machine providers primarily offer support through digital channels like call centers, email, or in-app messaging. Banks often provide dedicated merchant helpdesks and the option for direct, in-person support at physical branches, a preference for some business owners.

Integrations and Analytics

Modern payment terminals are powerful, but they work best when they are part of a bigger picture.

If you are ready to move beyond simple payments and want to see how a full Point of Sale setup can automate your daily admin, you should check this out. It covers everything you need to know about choosing the right solution for the South African market:

POS System: The Ultimate Guide to Card Machines in South Africa

Mobile App Ecosystems

Mobile devices are managed through intuitive mobile applications that form a self-contained ecosystem, offering more than payment processing. These applications provide:

- Real-time sales analytics (daily, weekly, monthly)

- Fundamental product and inventory management

- Digital invoicing and remote payment links

- Streamlined exporting of sales data for accounting software

Deep Integration with Bank POS

Traditional terminals are engineered for deep integration with sophisticated, third-party business management platforms. They are better suited for:

- Connecting to comprehensive retail or restaurant POS and Enterprise Resource Planning (ERP) software.

- Centralized, multi-location reporting and advanced chargeback management portals.

- Integration with ancillary hardware such as cash drawers and kitchen display systems.

As industry analysis confirms, mobile payment processing offers unparalleled speed and convenience for smaller operations, while traditional systems provide robust, integrated solutions for larger ones. Furthermore, both modern mPOS readers and traditional terminals adhere to the same stringent security standards, including PCI-DSS and EMV (chip-and-PIN), ensuring that customer data is secure regardless of the device type.

Scaling Your Payment Setup

If your current focus is a small-scale mobile operation, a standard card reader is a solid starting point. However, as you move toward higher transaction volumes or require multi-staff reporting, the gap between a basic app and a dedicated enterprise system becomes clear.

Eezipay provides the middle ground—Smart POS and MPT solutions that maintain the mobility of a handheld device while offering the deep operational insights and reliability usually restricted to fixed bank terminals.

Ready to streamline your business? Book a demo and we will explore the right path for your business.

The Final Verdict: Which Solution is Right for Your Enterprise?

The optimal choice between a mobile POS solution and a traditional terminal is contingent not on inherent superiority, but on alignment with your specific business model, scale, and strategic objectives.

- A Mobile POS Solution is the optimal choice for: New ventures, sole proprietors, businesses with mobile operations, or those experiencing fluctuating card transaction volumes. The minimal capital outlay, absence of fixed monthly fees, and superior operational agility are key advantages.

- A Traditional POS Terminal is recommended for: Established, high-volume enterprises operating from fixed locations. The preferential, negotiated transaction rates yield significant cost savings at scale, and the robust integration capabilities are essential for managing complex operations.

Don’t leave your payment strategy to chance. Analyze your cost structure and operational needs today to decide if a traditional terminal or a mobile card machine is the right catalyst for your business growth.