Managing staff deductions, allowances, and meal benefits has become increasingly complex for HR, payroll, and finance leaders—especially in multi-branch or high-volume environments. Manual reconciliation, error-prone spreadsheets, and delayed reporting often result in compliance risks, administrative bottlenecks, and unnecessary payroll disputes.

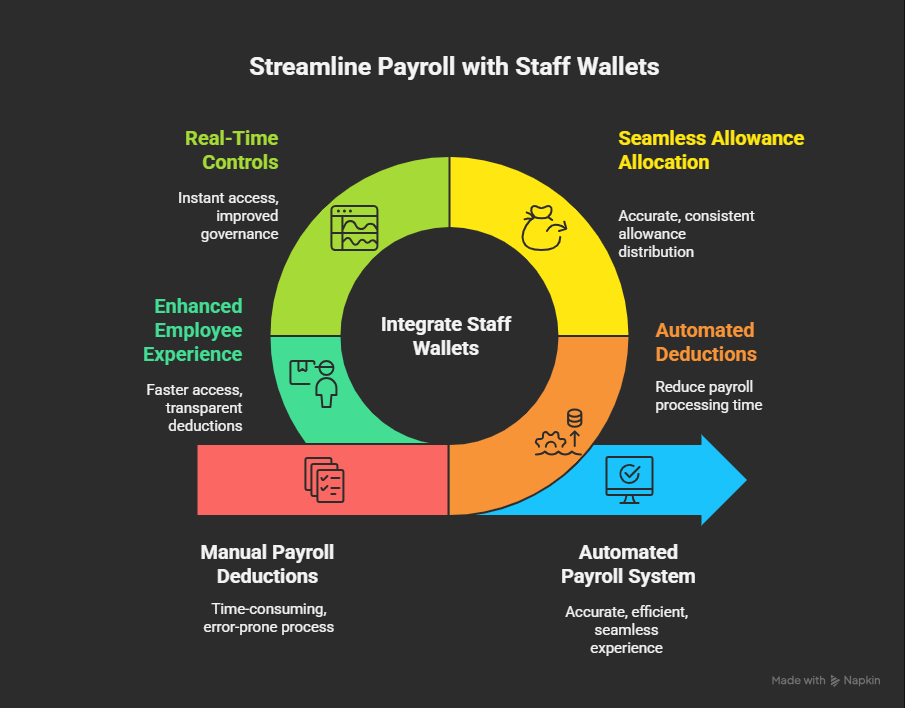

This is where payroll integration with digital staff wallet systems is transforming how modern organisations operate. By connecting secure, closed-loop staff wallets directly to payroll workflows, companies can automate deductions, streamline allowance management, and gain real-time financial visibility across the entire workforce.

In this blog, we explore how payroll-linked wallet systems work in practice, the operational and compliance advantages they offer, and the broader industry trends shaping the future of payroll automation. You will also learn how organisations are reducing admin, improving accuracy, and enhancing employee experience by moving from manual processes to integrated digital wallet workflows.

Table of Contents

Why Payroll Integration Matters for Modern Organisations

Payroll, HR, and finance teams are under growing pressure to manage higher transaction volumes, tighter compliance requirements, and increasingly complex employee benefit models. Traditional manual processes—like reconciling paper slips, managing store accounts, or updating spreadsheets—create inefficiencies that slow operations and introduce costly errors.

The Global Payroll Complexity Index 2025 highlights that payroll processing remains one of the most complex and administratively burdensome functions in global organisations, driven by high data volumes, regulatory variation, and fragmented internal systems. These factors significantly increase the risk of manual errors, delayed reconciliations, and compliance challenges.

As workplaces digitise, integrated financial ecosystems are becoming the norm rather than the exception. Staff wallet systems offer a practical solution by providing real-time control, transparency, and automation for employee spending—from meal allowances to payroll-deducted purchases. Integrated systems also minimise the compliance risks associated with untracked allowances or informal staff accounts, giving finance leaders better visibility and reducing audit pressure.

For a deeper look at how closed-loop systems enhance compliance and operational control, read our blog post, Closed-Loop Wallet Systems: Control, Compliance, and Convenience.

How Payroll-Integrated Staff Wallets Work

Payroll-integrated staff wallet systems connect employee allowances, deductions, and spending activity directly to payroll workflows, eliminating the need for manual reconciliation. Below is a clear breakdown of how this works in practice, using both industry standards and common organisational setups from organisations already implementing the Eezipay model.

1. Wallet Creation & Employee Enrolment

The process begins with HR uploading or syncing employee data into the staff wallet platform. Each employee is issued a secure, NFC-enabled card linked to their digital wallet, allowing controlled access to meals, allowances, or workplace purchases. Eezipay’s setup process includes staff batch uploads, card issuing, device configuration, and reporting dashboard activation, ensuring immediate operational readiness.

2. Funding Models: Allowances, Credit, and Hybrid Approaches

One of the biggest advantages of payroll integration is the flexibility it offers employers to fund staff wallets.

- Pre-loaded allowances: Employees receive a fixed monthly value (e.g., R1,100) for meals, with the employer maintaining a monthly float. Tax is applied only on actual consumption under SARS Code 3801, improving compliance and predictability.

- Credit-based spending: Employees spend throughout the month, and the total is automatically deducted from payroll via a custom Sage export. This replaces paper slips and eliminates manual reconciliation, while enforcing preset spend limits.

- Hybrid models: Used when organisations combine fixed allowances with payroll deductions for additional purchases.

3. Real-Time Spending & Merchant Restrictions

Staff wallets operate as closed-loop systems, meaning spending is limited to approved internal locations—canteens, cafeterias, or staff stores. This ensures compliance, prevents cash misuse, and centralises reporting.

For a broader explanation of closed-loop mechanisms, read our guide: What Is a Staff Wallet System? The Future of Cashless Workplaces.

4. Automated Month-End Reports

At month-end, the system automatically compiles all staff transactions—whether allowances or deduction-based—into payroll-ready reports. These exports align with major payroll platforms such as Sage or SAP, reducing reconciliation time and minimising manual intervention.

5. Float Reconciliation & Settlement

For organisations using allowance-based models, the system maintains a controlled employer float and reconciles spending in real time. Merchants receive periodic settlements, and finance teams gain clearer visibility of total consumption and upcoming payroll obligations.

Operational Benefits of Payroll-Linked Staff Wallets

Integrating staff wallets directly with payroll processes delivers measurable operational advantages for HR, finance, and operations teams. By replacing manual reconciliation and fragmented systems with automated workflows, organisations achieve higher accuracy, better visibility, and a more seamless employee experience.

1. Automated Deductions Reduce Payroll Load

Manual deduction matching can consume significant time in large organisations. Industry insights indicate that manual payroll inputs are a major source of payroll delays and errors, with HR teams frequently needing to correct misaligned or incomplete information.

2. Seamless Allowance Allocation

Whether an organisation provides monthly meal benefits, shift-based allowances, or controlled spending limits, automated wallet systems ensure allocations are issued accurately and consistently—without manual admin.

To learn more about compliance implications, see our guide on Fringe Benefits and SARS Compliance.

3. Real-Time Controls for HR and Finance

Through role-based access, HR and finance teams can view balances, adjust permissions, block cards, or manage spending limits instantly. Real-time dashboards improve governance and strengthen financial oversight without adding administrative burden.

4. Enhanced Employee Experience

Staff benefit from faster, more convenient access to meals and workplace purchases. Tap-to-pay cards, instant balance checks, and predictable payroll deductions remove friction from daily routines. Allowances are always accurate, deductions are transparent, and employees experience fewer payroll disputes.

To explore how digital wallets can enhance engagement, read our blog on wallets that improve staff experience.

Compliance Advantages: Tax, Finance & Data Governance

When payroll systems integrate directly with staff wallets, organisations gain stronger alignment with tax legislation, improved financial governance, and robust audit readiness. This is especially critical for employers managing allowances, meal benefits, or payroll-deducted staff purchases across multiple locations.

1. SARS-Aligned Fringe Benefit Reporting

For employers offering meal benefits or restricted-use allowances, payroll-integrated wallet systems ensure accurate, compliant reporting. Fringe-benefit values are calculated based on actual consumption, not estimated usage, helping organisations apply PAYE correctly under SARS regulations.

2. Closed-Loop System: No Cash, No Payroll Risk

Closed-loop wallets ensure funds cannot be withdrawn or transferred as cash, preventing remuneration misclassification and reducing compliance exposure. Spending is ring-fenced to approved internal merchants, aligning with regulatory expectations for controlled, non-cashable benefits.

3. Audit-Ready Reporting & Data Protection

Payroll-integrated wallets generate a complete, real-time audit trail for every transaction. Monthly consumption reports, merchant settlements, and float reconciliations are stored securely for up to five years, as required by FIC and POPIA regulations. HR and finance teams can access these records instantly, reducing the burden of internal audits, external reviews, and SARS inspections. This level of transparency strengthens internal controls and significantly reduces compliance risk for large organisations.

Manual Deductions vs Automated Payroll-Integrated Wallets

Manual deduction processes are time-consuming and prone to error. Automated payroll-integrated wallet systems eliminate these inefficiencies with real-time reporting and seamless reconciliation. The comparison below highlights the difference:

| Aspect | Manual Deductions | Automated Payroll-Integrated Wallets |

|---|---|---|

| Reconciliation Effort | High — requires slip matching and manual checks | Minimal — automated reports feed directly into payroll |

| Error Rate | Frequent inaccuracies due to human input | Very low — transactions recorded digitally at source |

| Compliance Risk | Higher — untracked or misreported benefits | Controlled — closed-loop, auditable, SARS-aligned |

| Processing Time | Slow month-end cycles | Faster payroll close and predictable workflows |

| Visibility & Reporting | Limited, often delayed | Real-time dashboards for HR and finance |

| Employee Transparency | Low — unclear balances or deductions | High — accurate balances and predictable payroll entries |

| Cost Impact | Increased admin cost and leakage | Reduced admin load and improved cost control |

This shift from manual to automated workflows not only improves accuracy but also strengthens governance—laying the foundation for scalable, compliant benefit management across all sites.

Business Impact: Efficiency, Cost Control & Scalability

Payroll-integrated staff wallets don’t just streamline processes—they deliver measurable business value across HR, finance, operations, and employee engagement. By creating a unified flow between spending, reporting, and payroll, organisations gain stronger financial control and significantly reduce operational overhead.

1. Reduced Admin & Reconciliation Time

Manual deduction matching can take hours—or even days—in large organisations. Industry insights show that manual payroll inputs and spreadsheet-driven processes are among the biggest contributors to payroll errors, rework, and reconciliation delays.

2. Improved Cash Flow Control

Allowance-based models support predictable budgeting and reduce leakage. Organisations can maintain a controlled float, track spending patterns in real time, and ensure payroll deductions or fringe-benefit values reflect actual usage—not estimates.

3. Scalability Across Multi-Branch or High-Volume Environments

Integrated wallet systems are cloud-based, allowing organisations to roll out consistent controls across multiple branches, stores, or canteens. HR and finance teams benefit from centralised dashboards, real-time transaction visibility, and role-based access permissions. This makes it easier to manage thousands of transactions across dispersed sites without losing control or compliance.

For organisations exploring suitable platforms, our blog on best wallet solutions for workplaces offers a comparative overview.

4. Real Case Example

Digital wallet integration also enhances revenue opportunities and simplifies daily operations. EFRC, for example, replaced a manual, paper-based store account system with a secure, payroll-linked digital wallet—allowing staff to shop at internal stores with preset limits, while HR receives automated deduction files at month-end.

See how Eezipay automated allowances efficiently at EFRC through a secure, payroll-linked wallet system.

Frequently Asked Questions (FAQ)

What is payroll integration?

Payroll integration refers to the process of connecting a digital system—such as a staff wallet platform—directly with an organisation’s payroll workflow. This allows deductions, allowances, and benefit values to flow automatically into payroll without manual data entry, reducing errors and streamlining month-end processing.

What is payroll integration in a digital wallet system?

In a digital wallet context, payroll integration means that all employee spending, allowances, or payroll-deducted purchases are automatically recorded in the wallet platform and exported as payroll-ready reports. HR and finance teams no longer need to reconcile slips or manually track balances—deductions and employer contributions are automatically applied based on real-time data.

How do payroll-linked staff wallets work?

Payroll-linked wallets assign each employee a secure, closed-loop digital wallet (or NFC card) that can be used at approved workplace locations, such as canteens or staff stores. Employees spend against pre-loaded allowances or credit-based limits, while employers receive automated month-end reports for payroll deduction or SARS-aligned fringe-benefit processing. Systems like Eezipay manage float balances, settlement, and compliance reporting seamlessly.

Can allowances be automated through digital wallets?

Yes. Digital wallet systems allow organisations to automatically assign recurring allowances such as meal benefits or shift-based entitlements, without manual processing. These allowances are loaded into staff wallets and restricted to approved merchants, ensuring accurate, compliant usage.

Are payroll-integrated staff wallets SARS-compliant?

Yes—when structured correctly. Closed-loop wallet systems support SARS compliance for both allowances and fringe benefits by ensuring funds are non-transferable, non-cashable, and restricted to approved merchants. For fringe-benefit meal vouchers, for example, employers are taxed only on the value consumed, not the value allocated—fully aligned with SARS Code 3801 requirements. Automated reports also simplify PAYE and audit processes.

What are the benefits of payroll integration for large organisations?

Large organisations benefit from reduced administrative load, fewer payroll errors, improved financial governance, and real-time visibility across branches. Automated deduction files eliminate manual reconciliation, while closed-loop controls ensure spending remains compliant and auditable. Integrated systems also improve staff experience by providing accurate balances, predictable deductions, and easy tap-to-pay functionality.

What are the three types of payroll?

Generally, payroll systems fall into three categories:

- Manual payroll – paper-based or spreadsheet-driven processes; high risk of errors.

- Partially automated payroll – software-assisted but still reliant on manual inputs.

- Fully integrated payroll – automated, system-to-system data flows that connect payroll with HR, finance, and operational platforms such as staff wallet systems.

This level of integration offers the highest accuracy, control, and scalability—ideal for organisations managing large workforces or complex benefit structures.

Conclusion: The Future of Payroll-Integrated Wallets in the Workplace

As organisations modernise their payroll and HR workflows, integrated staff wallet systems are quickly becoming essential. They automate deductions, streamline allowances, and provide clear, auditable financial records, significantly reducing the administrative load on HR and finance teams. Closed-loop wallets also ensure every transaction is controlled, compliant, and aligned with SARS requirements, replacing outdated manual processes that create risk and inefficiency.

For employees, integrated wallets offer a smoother experience: predictable deductions, accurate balances, and fast, cashless payments. As digital transformation accelerates, payroll-linked wallet systems will play a central role in building efficient, compliant, people-centric workplaces.

With proven success across multiple industries—from hospitality to agriculture—Eezipay provides the infrastructure, compliance framework, and reporting sophistication required to implement payroll-linked staff wallets across single-site or multi-branch environments. The future of workplace benefits is real-time, compliant, and integrated—and payroll-linked wallet systems are at the centre of that evolution.

Ready to Simplify Payroll Deductions?

Discover how Eezipay’s integrated Staff Wallet System can automate allowances, streamline deductions, and strengthen compliance across your organisation.

Book a tailored demo to see the system in action.

![How QR Code Payments Are Powering a Brighter Future for Universities [2025]](https://eezipay.com/wp-content/smush-webp/2025/05/QR-Codes-Payments-For-Universities-400x250.png.webp)