Managing staff benefits in a multi-branch organisation involves coordinating, allocating, and tracking employee allowances — such as meal subsidies, wellness funds, or staff shop credits — across multiple sites that each operate with distinct teams, systems, and workflows. As organisations grow, this process becomes increasingly complex. What starts as a simple, single-branch benefit programme quickly evolves into a network of disconnected systems, manual inputs, and inconsistent employee experiences.

For CFOs and Operations Managers, this complexity doesn’t just create administrative headaches; it undermines financial visibility, introduces payroll risk, and weakens the consistency of your workplace benefits. The result is a system that consumes time, limits control, and ultimately fails to provide the efficiency or fairness modern organisations need.

In this blog, we look at why multi-branch organisations struggle to maintain consistent, efficient benefit management, and how centralising your allowance system can simplify operations, improve accuracy, and deliver a fair, modern experience for employees across all sites.

Table of Contents

Why Multi-Branch Organisations Struggle With Staff Benefits

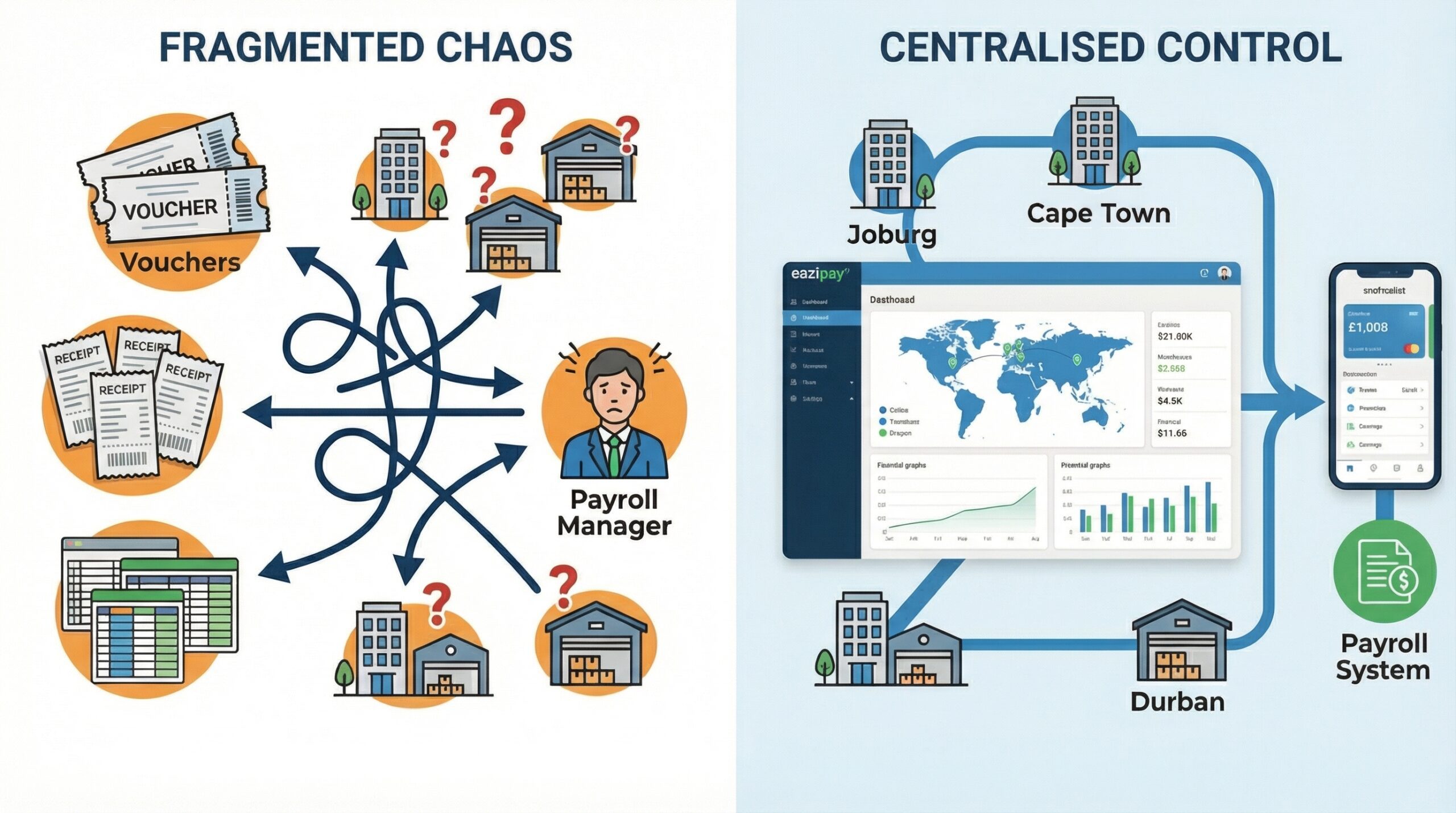

When each branch uses its own method to manage allowances — from paper vouchers to tills, spreadsheets, petty cash, or prepaid cards — the entire staff benefits ecosystem becomes siloed. These disjointed processes create operational friction and prevent finance and operations teams from getting the unified oversight they need.

This siloed approach consistently leads to three core problems for finance and operations teams: rising administrative burden, limited financial control, and inconsistent employee experiences across branches.

1. Administrative Overload & Payroll Inefficiency

The administrative burden often begins long before payroll even runs. Branch managers track allowances differently, sites use different systems, and the head office must manually reconcile it all. This creates an environment where operations and payroll teams spend hours each month:

- collating multiple spreadsheets,

- checking branch-level spending logs,

- requesting missing data,

- manually keying in adjustments, and

- correcting month-end discrepancies.

This extra manual effort dramatically increases the likelihood of errors — errors that become more expensive and more time-consuming as the organisation expands.

2. Lack of Financial Control

Without a unified system, finance teams cannot reliably answer critical questions such as:

- How much is each branch actually spending on staff benefits?

- Which allowances are being used, underused, or misused?

- Are spending patterns consistent across regions?

- How should budgets and forecasts be adjusted?

Fragmented systems inevitably lead to fragmented visibility. When every branch reports differently, decision-makers lack the clear, consolidated data needed to control costs or measure the real return on staff benefits.

3. A Disjointed Employee Experience

When one branch enjoys a seamless digital allowance system while another relies on delays, reimbursements, or paper processes, staff quickly notice the inconsistency. This uneven experience:

- undermines workplace fairness,

- reduces benefit uptake,

- increases frustration, and

- weakens the overall company culture.

In multi-branch environments where culture must stay cohesive, this inconsistency becomes a measurable risk.

The Solution: Centralising Your Staff Allowance System

The most effective way to eliminate these challenges is to shift from a fragmented, multi-system model to a single, centralised platform. A digital staff wallet system gives your organisation one unified place to manage all staff allowances — regardless of how many branches, departments, or regions you operate.

Centralisation transforms your staff benefits programme into a “single source of truth,” consolidating all branch activity into one real-time dashboard. Instead of juggling multiple processes across multiple sites, your team manages one system with standardised rules, automated controls, and full financial visibility.

Instead of managing 10 different systems for 10 locations, you manage one.

To learn how centralised systems connect directly with payroll, read our guide on Payroll Integration with Staff Wallets.

How a Centralised Digital Staff Wallet Works

A digital staff wallet brings automation, consistency, and payroll alignment into one streamlined process. Here’s how it works using a subsidised canteen:

1. Set the rules

For example: “All staff receive a R50 daily meal allowance.”

These rules can differ by branch, cost centre, or employee group — all of which are configured centrally.

2. Employees spend at approved locations

Staff tap their card or app at the canteen or staff shop.

3. Automatic calculation happens instantly

If the meal costs R75, the system automatically applies the R50 allowance. The remaining R25 is either deducted via payroll or taken from the employee’s personal balance.

4. Consolidated payroll reporting

At month-end, the platform generates a single report for all branches — fully itemised and ready to upload into payroll (Sage, SimplePay, VIP, etc.).

5. Upload into your payroll system

Your payroll team uploads a single file into Sage, SimplePay, VIP, or your existing payroll platform.

The entire workflow shifts from a multi-branch manual reconciliation process to a unified, automated process that takes minutes instead of days.

For a deeper look at the security and control advantages behind closed-loop systems, see Closed-Loop Wallet Benefits: Powerful, Secure Workplace Control

Manual vs. Integrated Allowance Systems

Before choosing an approach, it’s helpful to understand the operational and financial differences between a fragmented process and a unified digital system.

| Feature | Fragmented, Manual Approach | Centralised Digital Staff Wallet (Eezipay) |

|---|---|---|

| Allowance Allocation | Branch-by-branch spreadsheets | Automated rules across all sites |

| Payroll Processing | Multiple inputs, error-prone | One consolidated deduction file |

| Financial Reporting | Delayed, inconsistent | Real-time, consolidated data |

| Risk & Compliance | Higher fraud/misuse risk | Closed-loop, controlled environment |

| Adding a New Branch | New processes, more admin | Add a location — rules apply instantly |

| Employee Experience | Uneven across branches | Consistent, digital-first experience |

How Centralisation Improves Operational Efficiency

A centralised allowance system doesn’t just save time — it transforms the way your operations and finance teams function.

For Operations Managers, centralisation means:

- Consistent processes across every branch

- Faster onboarding for new sites or seasonal teams

- Reduced reliance on branch managers for reporting

- A single view of device activity, site performance, and staff usage

- Predictable workflows that don’t require end-of-month firefighting

For CFOs, it delivers:

- Clear visibility of total staff benefits spend

- Better auditability and stronger controls

- Improved forecasting through real-time data

- Reduced financial risk through closed-loop controls

- Confidence that allowance policies are being applied uniformly

Instead of managing complexity, your teams can focus on optimisation as the system handles the heavy lifting.

A Better, Fairer Employee Experience Across All Branches

While the operational and financial gains are compelling, a centralised system has a powerful secondary effect: it helps build a unified company culture. With a unified digital system, every staff member receives the same level of access, convenience, and transparency, no matter which branch they work in.

Instead of dealing with slips, delays, or inconsistent rules, employees enjoy:

- quick, cashless transactions

- real-time balance visibility,

- predictable benefit availability, and

- confidence that all branches follow the same policies.

This fairness and transparency help strengthen culture, reduce frustration, and create a sense of equal opportunity across your entire workforce. When staff benefits feel modern and reliable, employees actually use them, and managers see improved morale and smoother daily operations.

Explore how digital wallets can enhance staff wellbeing in Employee Wellness Boost: 5 Proven Digital Wallet Benefits

Why Eezipay Is the Ideal Platform for Multi-Branch Benefit Management

Eezipay’s closed-loop staff wallet is built specifically for multi-branch organisations that need efficiency, consistency, and compliance.

With Eezipay, you get:

✓ One central dashboard for all branches

✓ Real-time reporting for finance and operations

✓ Automated, payroll-ready deduction files

✓ Branch-specific rules, limits, and configurations

✓ Closed-loop security and compliance controls

✓ Scalable deployment for new branches, devices, and teams

It’s not just a digital wallet — it’s an operational framework for staff benefits.

Take Control of Multi-Branch Staff Benefits

Managing staff benefits across multiple locations does not need to be chaotic, manual, or inconsistent. With a centralised allowance system and a digital staff wallet, you can modernise your operations, standardise your processes, and gain complete control over your benefit spend — all while improving the employee experience at every branch.

Now is the time to streamline, automate, and unify your staff benefits programme.

Ready to Streamline Your Multi-Branch Benefits?

See how Eezipay can unify your allowance system and give you full visibility across all branches.

👉 Book a demo to streamline benefits across branches